Post-Election Analysis 2016: Insurance

Transition Team for Insurance and Financial Services

- William Hagerty – Director of Appointments, Trump Transition Team

- Eric Ueland – Staff Director, Senate Budget Committee

- Paul Winfree – Heritage Foundation economist

- Daris Meeks – Attorney

Insurance and Financial Services Advisors

- Stephen Moore – Heritage Foundation

- Peter Navarro – Professor, Univ. of California Irvine

- Wilbur Ross – Investor, WL Ross and Co.

- Anthony Scaramucci – Managing Partner, SkyBridge Capital

- Steve Feinberg – CEO of Cerberus Capital Management

- Stephen Calk – Founder and Chairman, The Federal Savings Bank

- Howard Lorber – Chairman of Douglas Elliman (real estate brokerage)

- David Malpass – Founder of economic consulting firm Encima Global

- Steven Mnuchin – Former Goldman Sachs banker and film producer

- John Paulson – President and CEO of investment firm Paulson & Co.

- Steven Roth – Founder and chairman of Vornado Realty Trust

ADMINISTRATION PRIORITIES

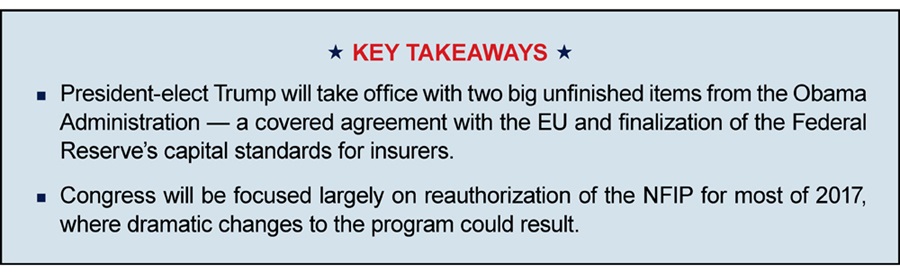

President-elect Trump's policy agenda in the insurance realm will likely be limited – as it is for most administrations – given the state-based regulatory system. Nevertheless, the Trump Administration will inherit a number of outstanding insurance matters that will require high-level attention.

Covered Agreement Negotiations with the European Union. The Obama Administration's Treasury Department and the US Trade Representative (USTR) have been in the process of negotiating a "covered agreement" with the European Union (EU) over the past year to address concerns regarding the treatment of US firms by European regulators under Solvency II, as well as concerns by non-US reinsurers about state-level reinsurance collateral requirements.

While negotiations are ongoing, both sides continue to express optimism that an agreement will be reached. An agreement is likely to grant the United States "temporary equivalence" under Solvency II, while providing for some form of collateral reduction for EU-based reinsurers (likely based in part on the National Association of Insurance Commissioners' (NAIC) Credit for Reinsurance Model Law). An agreement along these lines was contemplated even prior to the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) – indeed, the covered agreement provisions of Title V were crafted with this purpose in mind – and there is increasing interest on both sides of the aisle to see an agreement concluded. Should an agreement be reached it may only take effect after a 90-day "layover" period for congressional review.

The ability of a covered agreement to preempt state law on a limited basis, while seen as necessary to effectuate international commitments, is the NAIC's principal reason for opposing the current negotiations. The NAIC's opposition, however, may not be enough to prompt congressional action to stop a deal if it is seen as positive for the United States.

If an agreement is not reached prior to President-elect Trump taking office, several of the US negotiators are likely to change, and an agreement is likely to be delayed further. It is unclear, however, whether there would be any substantial shift in position on the covered agreement from the Obama Administration to the Trump Administration.

Insurance Capital Standards. The Federal Reserve (Fed) continues to develop capital standards tailored for insurers that they supervise by virtue of the fact that the insurer (a) has been designated as a systemically important financial institution (SIFI) by the Financial Stability Oversight Council (FSOC), or (b) owns a bank or thrift.

The Fed issued a long-awaited advance notice of proposed rulemaking laying out a proposed regulatory framework in June 2016, but final regulations do not appear imminent. The next administration will be tasked with finalizing these regulations while continuing to engage with stakeholders.

Cyber Insurance. The Treasury Department, particularly Deputy Secretary Sarah Bloom Raskin, has taken an active interest in promoting the development of the cyber insurance market. Treasury, as well as some members of Congress, have taken the view that such insurance can be an effective market-based driver of better cyber hygiene among businesses of all sizes. While this issue has generally not been a partisan one, it is unclear whether the incoming administration will take a similar interest in monitoring the growth of the cyber insurance market and pursuing policies to foster its development.

AGENCY LEADERSHIP

There are only two positions at the federal level that deal specifically with insurance: the independent insurance expert serving on the FSOC and the Director of the Federal Insurance Office (FIO).

In the case of the FIO Director, that position is appointed by the Treasury Secretary – not the President – so the most likely candidates may not be known until after the new Treasury Secretary is named. Current FIO Director Michael McRaith is almost certainly not a candidate to continue in the position in a Trump Administration.

The FSOC's Independent Member with Insurance Expertise, Roy Woodall, is nearing the end of his six-year term, which will expire in September 2017, and thus the Trump Administration will need to either reappoint Mr. Woodall or appoint a replacement.

CONGRESSIONAL LEADERSHIP

House. Rep. Jeb Hensarling (R-TX) will remain chair of the House Financial Services Committee, a position he has held since 2013. His Democratic counterpart on the committee will once again be Ranking Member Maxine Waters (D-CA).

Senate. Sen. Michael Crapo (R-ID) will likely be the new chair of the Senate Banking Committee, as the outgoing chair, Sen. Richard Shelby (R-AL), is term-limited. Sen. Crapo previously served as ranking member of the committee from 2013-2014. Sen. Sherrod Brown (D-OH) will remain as ranking member.

CONGRESSIONAL PRIORITIES

With Republicans retaining control of the Senate and the House and gaining the White House, they will have a freer hand to pursue legislative priorities in Congress provided it is not contrary to the administration's agenda. The Republicans' narrow majority in the Senate combined with procedural rules that give the minority party substantial power, however, mean that Democrats will be able to obstruct certain policy measures. The dynamics may be similar to what Senate Republicans did in the first two years of the Obama Administration. All that having been said, insurance regulatory policy debates do not always fall neatly along party lines.

Flood Insurance Reauthorization. The Biggert-Waters Flood Insurance Modernization Act of 2012 is due to sunset on September 30, 2017, perhaps making the reauthorization of the National Flood Insurance Program (NFIP) the most pressing congressional insurance priority. The issue is likely to remain in the forefront given that Sen. Chuck Schumer (D-NY), who has been extremely active on flood insurance issues following Superstorm Sandy, will take over as Senate Minority Leader.

With a current debt estimated at $23 billion, the NFIP remains controversial on a variety of fronts, and we anticipate numerous proposals to drastically change the program in the coming year. Chair Hensarling and a number of his Republican colleagues have made no secret of their desire to see greater participation of the private sector in flood insurance, while Ranking Member Waters has advocated forgiveness of the $23 billion debt as part of the reform effort.

There have been a number of flood insurance-related hearings in Congress during 2016 in preparation for the reauthorization, and we expect there will be more throughout 2017. Given the timing of the program's expiration, action on reauthorization legislation is likely to commence quickly in the new year. The Trump Administration will be, to some extent, a latecomer to this debate, but will play no less critical a role.

International Capital Standards. With Republicans holding their majority in the House, we expect that congressional scrutiny of US participation at the International Association of Insurance Supervisors (IAIS) will continue much as it has in recent years. In particular, the concern that the IAIS may adopt an international capital standard that is inconsistent with the US regulatory structure has led to numerous congressional hearings over the past several years focused on how the US participates at the IAIS, and what the implications such standards could have for US competitiveness.

Terrorism Risk Insurance Act. While the Terrorism Risk Insurance Act (TRIA) is not set to expire until 2020, some industry stakeholders have suggested that Congress continue to examine potential changes to the program far in advance of that sunset, given the market disruption caused by last-minute reauthorization (or, in the case of the latest reauthorization, the brief lapse of the program). To this end, congressional hearings on TRIA are possible in the 115th Congress, although we do not anticipate any effort to move legislation.

Our full analysis of the 2016 election is available below.