Post-Election Analysis 2016: Healthcare, Life Sciences & FDA

Transition Team for Healthcare

- Rich Bagger – Executive Vice President at Celgene Corp.

- Jamie Burke – Principal at Burke Consulting, LLC

Healthcare Advisors

- John Ridings Lee - CEO of North American National Risk Service, LLC

Administration Priorities

President-elect Trump's transition team for healthcare is led by Rich Bagger, who is currently an executive at Celgene Corp. and was previously at Pfizer. Mr. Trump's principal healthcare advisor, John Ridings Lee, is a longtime insurance company executive and personal friend. The campaign's healthcare agenda was developed with little input from inside-the-Beltway veterans of previous Republican administrations.

Affordable Care Act. The healthcare agenda for the incoming administration is as simple as a sound bite, but the devil is, as always, in the details. The President-elect campaigned by promising to repeal the ACA and replace it with a series of reforms that will follow free market principles, including eliminating the individual mandate and broadening healthcare access, purporting to make healthcare more affordable and higher in quality. A full repeal of the ACA also would eliminate popular insurance market reforms, such as community rating and guaranteed issue, as well as the Medicare Part D coverage gap discount program. Repealing the ACA's payment rate cuts to healthcare providers, such as hospitals, post-acute care facilities, and Medicare Advantage plans, would increase federal entitlement spending by over $700 billion, according to the Congressional Budget Office's (CBO) 2012 estimate.

President-elect Trump's platform also includes a plan to permit the sale of health insurance across state lines, while converting Medicaid to a block grant program. States are expected to make up any shortfalls in federal funding by eliminating fraud and abuse. The plan also would permit individuals to fully deduct health insurance premium payments from their taxes, and permit tax-free contributions to health savings accounts that could be used by any member of a family and passed on to heirs without a death penalty.

Repealing the ACA is estimated to result in a loss of insurance coverage for about 20 million Americans, according to a RAND Corporation economic model. Permitting a new tax deduction for health insurance would cause a smaller loss of coverage, of 15.6 million individuals. On the other hand, converting Medicaid to a block grant program would result in 25 million fewer individuals having coverage in 2018. The political fallout that would result from such a massive loss of insurance coverage likely will cause Congress to look for alternative strategies, as discussed below.

Prescription Drug Pricing and Drug Importation. On the campaign trail, President-elect Trump broke rank with many Republicans in Congress, such as House Ways and Means Committee Chair Kevin Brady (R-TX), when he announced that he would permit Medicare to negotiate prescription drug prices. The campaign website describes only one proposal relating to lowering prescription drug prices, which would permit importation of "safe and dependable drugs from overseas." Whether President-elect Trump will actually effectively move on such initiatives, however, remains to be seen.

Regulatory Actions. President-elect Trump's campaign website claims that he will "put the job-killing regulation industry out of business," "issue a temporary moratorium on new agency regulations," and "cancel immediately all illegal and overreaching executive orders." Republican members of Congress have expressed concerns about many of the activities of the Center for Medicare and Medicaid Innovation (CMMI), but the CBO has estimated that repealing its authority would cost $34 billion over the next decade. That being the case, expect President-elect Trump to wind down current CMMI initiatives, such as the Comprehensive Care for Joint Replacement Model, the Oncology Care Model, and certain accountable care organizations (ACOs) over the next few years, and to halt new initiatives that were proposed by the Obama Administration but have not yet started, such as the Medicare Part B Drug Payment Model.

Food and Drug Administration. Although little has been said by the Trump campaign about FDA policy, it is likely that President-elect Trump would support federal enactment of the "Right to Try" legislation that has been enacted in many states, and seek to lower barriers to expanded access to drugs by terminally ill patients. More generally, we expect the Trump Administration's deregulatory agenda to include efforts to speed drugs to market, such as through greater reliance on real-world evidence. The FDA also will be under enormous pressure to issue guidance clarifying the boundaries for communication of truthful and non-misleading unapproved use information; if not, Congress will act to redefine the FDA's authority from a statutory perspective. This may be part of a lame duck attempt to pass the 21st Century Cures Act, or as part of user fee reauthorizations next year. We also expect that the effort to institute broader FDA regulation of laboratory-developed tests will be greatly diminished in scope, if not abandoned.

MACRA Implementation. The Medicare and CHIP Reauthorization Act of 2015 (MACRA) was passed by Congress a few weeks after Health and Human Services (HHS) Secretary Sylvia M. Burwell announced a goal of tying 50 percent of Medicare fee-for-service payments to quality or value through alternative payment models (APMs), such as accountable care organizations or bundled payments, by the end of 2018. The incoming Trump Administration's deregulatory agenda could wind down the CMMI's APM pilots, leaving only the highest-performing physicians and other healthcare professionals in the Merit-Based Incentive Payment System (MIPS) eligible to benefit from MACRA's $500 million pool of bonus payments. If the Centers for Medicare and Medicaid Services (CMS) does wind down the number of APMs, forcing virtually all physicians to participate in MIPS, then it is likely that CMS will continue to provide other avenues for physicians to avoid penalties, such as extending the policy for 2017 where reporting of a single quality measure avoids penalties. The MACRA final rule, released October 14, gives eligible clinicians in MIPS flexibility to report for a 90-day period rather than a full year as proposed, and will help those in small practices and those that have not previously participated in the legacy programs with the transition. The final rule revises the low-volume threshold to exclude roughly one-third of clinicians from the reporting requirements and payment adjustments and reduces the number of improvement activities participating clinicians must report. CMS will not count the cost category toward clinicians' total scores in the first year and has further reduced the number of required objectives and measures for clinicians' use of electronic health records (EHRs). However, CMS expects that most MIPS-eligible clinicians will be ready to meet Stage 3 objectives and measures using an EHR certified to the 2015 edition, which may prove to be an overly ambitious goal as no such EHR is yet on the market. President-elect Trump has not spoken publicly about MACRA or physician payment reform, so it remains unclear whether the new administration will support MACRA implementation. Republican (and Democratic) support offers some level of protection for the overarching goals of the law, but implementation issues could lead to policy modifications and delays.

AGENCY LEADERSHIP

President-elect Trump's choice for a Secretary of Health and Human Services will most certainly be a strong critic of the Affordable Care Act. Potential nominees include Florida Governor Rick Scott, Louisiana Governor Bobby Jindal, and retired pediatric neurosurgeon Ben Carson, MD, who ran in the Republican primary. The fate of FDA Commissioner Califf is not clear at this time, although it is possible that he will remain in place in the near term.

CONGRESSIONAL LEADERSHIP

House. The 115th Congress will bring new leadership to the Energy and Commerce Committee, both at the full committee and Health Subcommittee levels. Republican term limits prevent Rep. Fred Upton (R-MI) from continuing as chair of the full committee. Rep. Upton has served as the Republican lead of the committee since 2010, and has spent the final years of his tenure championing the 21st Century Cures Initiative, which aims to accelerate the pace of drug and device discovery, development, and delivery. Three committee members are vying for the gavel, including Rep. John Shimkus (R-IL), National Republican Congressional Committee Chair Greg Walden (R-OR), with a long-shot bid from Chairman Emeritus Joe Barton (R-TX), who chaired the committee from 2004 to 2007. While Rep. Shimkus's seniority was thought to give him a slight edge, Rep. Walden has been praised for his fundraising prowess and leadership this cycle, which helped to preserve the Republican majority in the House. Both Reps. Shimkus and Walden have impressive records of service on the committee, though it would be notable if the Steering Committee disrupted regular order of seniority. Rep. Frank Pallone (D-NJ) is expected to continue to serve as ranking member.

The Energy and Commerce Subcommittee on Health will also see a shakeup as Chair Joe Pitts (R-PA) will retire after serving ten terms in Congress, and the past six years leading the Health Subcommittee. There are two healthcare professionals pursuing the role of ranking member, including Rep. Tim Murphy, PhD (R-PA), a psychologist who earned distinction by championing mental health reform, and Rep. Michael Burgess, MD (R-TX), an obstetrician, who has long taken an informal leadership role at the committee on health policy issues. While Rep. Burgess currently serves as the Commerce Subcommittee chair, we expect a sincere attempt to win the leadership post on the Health Subcommittee. Rep. Gene Green (D-TX) will likely continue to serve as ranking member.

Chair Kevin Brady (R-TX) and Ranking Member Sander Levin (D-MI) are expected to continue to lead the Ways & Means Committee, which oversees tax policies and several federal healthcare programs. While Rep. Pat Tiberi (R-OH) will likely remain as chair of the Health Subcommittee, Ranking Member Jim McDermott (D-WA) will leave a vacancy when he retires at the end of this year. Rep. Mike Thompson (D-CA) and Rep. Ron Kind (D-WI) are the next Democrats in line on the subcommittee.

Senate. With Republicans retaining control of the Senate, Chair Lamar Alexander (R-TN) and Ranking Member Patty Murray (D-WA) will continue in their roles leading the Health, Education, Labor, and Pensions (HELP) Committee.

Similarly, on the Finance Committee, Chair Orrin Hatch (R-UT) and Ranking Member Ron Wyden (D-OR) are expected to retain their positions. Health Subcommittee Chair Pat Toomey (R-PA) won a tight race, and is expected to continue as Chair. Ranking Member Debbie Stabenow (D-MI) will continue as ranking member of the Health Subcommittee.

CONGRESSIONAL PRIORITIES

Following a challenging election year, the 114th Congress will adjourn with several, significant healthcare proposals left unresolved. We anticipate that lawmakers will have several key policies to grapple with from the start. Medical innovation reforms − which have been championed by outgoing Energy and Commerce Committee Chair Upton, and have been named as a top priority for Speaker Paul Ryan (R-WI) and Majority Leader Mitch McConnell (R-KY) − will remain a priority, if not passed before the end of the year. Other unresolved issues may include mental health reform and funding to respond to the opioid epidemic. There will be several must-pass healthcare packages in the 115th Congress that could serve as a vehicle for these policies, with authorizations for several healthcare programs expiring at the end of FY 2017, including the Children's Health Insurance Program (CHIP) and the FDA user fee programs (Prescription Drug User Fee Act (PDUFA), Medical Device User Fee Act (MDUFA), the Biosimilars User Fee Act (BsUFA), and the Generic Drug User Fee Act (GDUFA)).

Affordable Care Act. With Republicans in control of the administration and both chambers, they will be in the ideal position to repeal and replace the ACA, and overcome Democrats' calls to improve the existing law. While many implemented provisions may prove challenging to undo, we can expect the Republican Congress and Administration to pursue repeal vigorously.

The Republicans' ACA repeal-and-replace effort will be guided by Speaker Paul Ryan's A Better Way, which the Speaker has repeatedly called "our plan for 2017." Republicans support repealing the ACA in its entirety, and have emphasized provisions that they perceive as particularly burdensome or costly, including the individual and employer mandates, the Independent Payment Advisory Board (IPAB), CMMI, the medical device tax, and the excise tax on high-cost employer health benefit plans (Cadillac tax). Republicans propose replacing the ACA with a competitive, consumer-driven plan that provides individuals and families with a monthly, universal, advanceable, refundable tax credit, adjusted for age, that could be used to help offset the cost of purchasing coverage. The Republicans' plan would expand the use of health savings accounts (HSAs) and health reimbursement accounts (HRAs), make coverage portable from job-to-job, and allow purchase of insurance across state lines. It would likely retain popular consumer protections enacted under the ACA, including the ban on coverage denials or exclusions based on preexisting conditions. While Speaker Ryan has suggested that the House may use reconciliation to repeal the law, they may not have to rely on the procedure with a Republican-controlled administration and Congress.

In some instances, Republicans may be joined by the growing number of Democrats who have become open to exploring fixes to the ACA. For example, a bipartisan majority voted to place a moratorium on the medical device tax through December 31, 2017. While there is a significant cost associated with permanent repeal, lawmakers are expected to consider attaching a short-term extension of the moratorium on the medical device tax to the MDUFA reauthorization bill.

Medicare. With a Republican Congress and administration, we anticipate that traditional GOP themes on entitlement reform will be back in play. The CBO projects that Medicare spending will double by 2026, and the Medicare Trustees estimate that the Medicare Hospital Insurance (HI) trust fund will expire in 2028, which is two years earlier than last year's report.

House Speaker Paul Ryan's plan, endorsed as the official Republican platform, calls for significant changes to the Medicare benefit. Those changes include combining Part A and Part B with a unified deductible, 20 percent coinsurance, and a catastrophic limit, which the CBO in 2013 estimated would reduce federal spending by $54 billion over the next decade. Another element of the plan would permit the Medicare Advantage program to compete against traditional Medicare in a premium support model where the government makes a defined contribution and beneficiaries are liable for additional costs. CBO estimated in 2013 that premium support could reduce Medicare spending (and shift costs onto beneficiaries) by anywhere from $22 billion to $275 billion over the next decade, depending upon how the federal contribution is structured.

In an effort to address rising costs, the Ways and Means and Finance Committees will likely continue to examine payment reforms, which will be informed by the Medicare Payment Advisory Commission's (MedPAC) repeated calls for bundled and site-neutral payments. A particular emphasis during the 114th Congress has been addressing the treatment of chronic conditions, which accounts for 93 percent of Medicare spending. If the Finance Committee's bipartisan Chronic Care Working Group, led by Sen. Johnny Isakson (R-GA) and Sen. Mark Warner (D-VA), is not able to pass legislation before the end of this year, we expect that it will continue its effort in the 115th Congress.

Lawmakers are also expected to continue efforts to combat Medicare fraud and abuse, which contributes to billions of dollars in improper payments per year. A particular focus during the past year has been exploring reforms to the Stark law, which prohibits physician self-referrals in the Medicare and Medicaid programs. Following a December 2015 roundtable, jointly hosted by the Senate Finance and House Ways and Means Committees, Finance Committee Chair Hatch released a white paper on stakeholders' perspectives for improving the law. While policy proposals have not been distilled into legislation yet, this effort will likely continue in the 115th Congress.

Congress will also closely oversee CMS's implementation of MIPS and APMs, the new physician payment systems under MACRA. Both the Ways and Means Committee and the Finance Committee called CMS Acting Administrator Andy Slavitt to testify on MACRA implementation earlier this year. More recently, bipartisan House members urged Secretary Burwell to consider "flexibilities for all practitioners" when implementing the Quality Payment Programs under MACRA.

Medicaid and the Children's Health Insurance Program. Nearly five years after the US Supreme Court ruled that states may choose whether to expand Medicaid, lawmakers continue to debate how to cover individuals in the 19 non-expansion states. Democrats have vowed in their platform to "keep fighting" until Medicaid expansion is adopted in all states. However, with a Republican Administration and Congress, lawmakers will be in a strong position to push policies that emphasize state authority and administration of the program. Speaker Ryan's A Better Way proposes two alternatives to Medicaid expansion that states could choose between: (1) block grant; or (2) per capita allotment, which would make available, starting in 2019, a total federal Medicaid allotment that states could draw down on based on their federal matching rate.

Congressional discussions will be influenced by recommendations from the Medicaid and CHIP Payment and Access Commission (MACPAC), which recently conducted analyses of drivers of Medicaid spending and made recommendations to Congress looking at ways to reduce state and federal expenditures through alternative financing approaches and policy choices. In addition, MACPAC is conducting analyses around how Medicaid expansion affects states' uncompensated care, impacting states disproportionate share hospital (DSH) allotments, findings which will influence recommendations to the 115th Congress on DSH payments.

Lawmakers will also look to reauthorize CHIP, which was extended under MACRA through FY 2017. CHIP reauthorization has historically enjoyed bipartisan support, though Republicans will have to contend with the 23 percent enhanced Federal Medical Assistance Percentage (FMAP) under pressure from states relying on the additional support. A proposal to allow states to use CHIP funds to purchase coverage for eligible children in the exchanges has been critiqued by MACPAC Commissioners and is not likely to be supported by either party. Many of the Commissioners have agreed that CHIP funding should be extended for a minimum of five years, but are divided over whether the maintenance of eligibility provision and enhanced federal match should be extended or phased out, proposals which will be voted on in December 2016 and will influence legislative proposals on children's healthcare coverage.

Prescription Drug Pricing. As publicity and congressional scrutiny over rising prescription drug prices has intensified, drug pricing is going to be a key issue in 2017. During the 114th Congress, several healthcare and oversight committees held hearings on drug pricing practices, and several bills aimed at increasing competition and lowering federal drug spending were introduced. While Republicans have traditionally been a more sympathetic audience on issues surrounding research and development, we expect prominent leaders like Sen. Chuck Grassley (R-IA) to remain vigilant in their work to combat rising drug prices. As is the case historically, we expect that proposals aimed at curbing spending under Medicare Part D, which is estimated to account for $94 billion of government spending in 2017, will be reintroduced during the 115th Congress. Common Part D drug pricing proposals include repealing the noninterference clause, requiring rebates from manufacturers for drugs for low-income beneficiaries, reimportation, accelerating closure of the Part D coverage gap, and prohibiting payfor-delay agreements, all of which enjoy support from congressional Democrats but many of which have been fiercely opposed by Republicans. We expect little action on major policies despite potential pressure from the Trump Administration on policies such as reimportation.

Part B drug pricing has also gained increasing attention, in light of CMS proposing a new Part B Drug Payment Model to test alternative payment models for Part B drugs in an effort to drive down the $22 billion Medicare spent on Part B drugs in 2015. Though not yet finalized, bipartisan lawmakers have criticized the far-reaching, mandatory nature of the proposed model through means such as a House letter sent to CMS with 242 member signatures. Unless the final rule makes necessary modifications, we expect the new Congress to continue fighting to halt the demonstration. Rep. Larry Bucshon (R-IN) introduced legislation this Congress to block the program, which we expect to be reintroduced next Congress, unless the new administration withdraws the demonstration first. The bill was scored at $395 million over ten years, lower than many initially expected, boding well for potential action in Congress. We also expect to see Republican efforts to abolish CMMI altogether, either as part of ACA repeal or stand-alone.

An increase in spending on drugs by the federal government also impacts safety-net hospitals who rely on the 340B Drug Discount Program in order to provide outpatient drugs to the low income populations they serve. To date, Congress has held off on any major reforms to the 340B program, awaiting the Health Resources and Services Administration to clarify certain 340B guidelines through regulation. However, we may see legislation introduced prior to any actions taken by the agency.

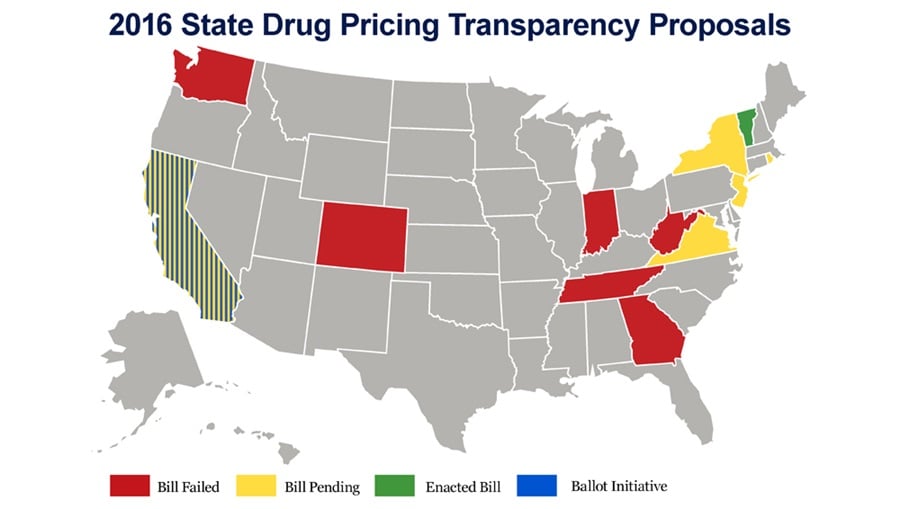

The battle over the cost of drugs is not restricted to the federal government, with nearly a dozen state governments considering legislation to increase transparency into manufacturers' practice of drug pricing, which was already signed into law in the state of Vermont. Efforts at the state level are likely to put added pressure on the federal government to take action. Aside from federal proposals to increase transparency of drug prices through means like the creation of a drug pricing oversight panel, other proposals likely to seek attention in the next Congress aim to introduce more generics into the marketplace to increase competition and drive down costs.

A bill attracting significant interest is the Creating and Restoring Equal Access to Equivalent Samples Act (CREATES Act), which seeks to reduce delays and anticompetitive practices in bringing generic drugs and biosimilars to the market. The bill addresses the Risk Evaluation and Mitigation Strategies (REMS), which are designed to ensure that higher-risk drugs are dispensed safely to patients, but which the sponsoring senators allege has been used by brand-name drug companies to prevent potential generic competitors from obtaining drug product needed as part of the generic development process. House and Senate health committee leaders are considering modified language that could be used as an offset for the 21st Century Cures medical innovation bills.

Medical Innovation. If congressional leaders are not able to move a package of biomedical innovation bills during the lame-duck session, action will be a top priority at the beginning of the 115th Congress. Both chambers have independently considered legislation that aims to accelerate the pace of drug discovery, development, and delivery. The House passed the comprehensive 21st Century Cures Act, while the Senate HELP Committee's analogous effort, known as Innovation for Healthier Americans, stalled amid negotiations over offsets and whether to authorize mandatory funding for the National Institutes of Health (NIH). While the medical innovation package could move on its own, it is likely that it would be attached to one of next year's several must-pass healthcare vehicles - most likely, PDUFA reauthorization.

Food. Though the Child Nutrition Act (CNA) expired at the end of FY 2015, Congress will continue discussing reauthorization of the law that governs the school meals programs and the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC). The House Education and Workforce Committee and the Senate Committee on Agriculture, Nutrition, and Forestry have both moved reauthorization bills out of committee, but neither has been brought to the floor.

Additionally, with the Agricultural Act of 2014 (Farm Bill) expiring at the end of FY 2018, the 115th Congress will need to reauthorize the law that governs several nutrition and agriculture programs, including the Supplemental Nutrition Assistance Program (SNAP), commodity programs, and crop insurance. Debates that were raised during the 2014 Farm Bill reauthorization are expected to resurface, including the Republican-backed proposal to block grant SNAP.

Cosmetics. The push for increased FDA oversight over cosmetics may gain some traction in the 115th Congress. Sens. Dianne Feinstein (D-CA) and Susan Collins (R-ME), Energy and Commerce Committee Ranking Member Pallone, and Rep. Leonard Lance (R-NJ) have increased visibility of this issue. Their bicameral proposals include requiring manufacturers to register with the FDA, directing FDA to establish good manufacturing practice (GMP) regulations for cosmetics, updating labeling requirements, giving FDA mandatory recall authority, and requiring manufacturers to report serious adverse events to the agency. If passed by Congress, the legislation would likely face a veto from President-elect Trump. Though President-elect Trump has not specifically addressed this policy, he has called for reducing the role of the federal government and rolling back FDA's food safety regulations.