Post-Election Analysis 2016: Financial Services

Transition Team for Financial Services

- William Hagerty – Director of Appointments, Trump Transition Team

- Eric Ueland – Staff Director, Senate Budget Committee

- Paul Winfree – Heritage Foundation economist

- Daris Meeks – Attorney

Financial Services Advisors

- Stephen Moore – Heritage Foundation

- Peter Navarro – Professor, University of California Irvine

- Wilbur Ross – Investor, WL Ross and Co.

- Anthony Scaramucci – Managing Partner, SkyBridge Capital

- Steve Feinberg – CEO of Cerberus Capital Management

- Stephen Calk – Founder and Chairman, The Federal Savings Bank

- Howard Lorber – Chairman of Douglas Elliman (real estate brokerage)

- David Malpass – Founder of economic consulting firm Encima Global

- Steven Mnuchin – Former Goldman Sachs banker and film producer

- John Paulson – President and CEO of investment firm Paulson & Co.

- Steven Roth – Founder and Chairman of Vornado Realty Trust

- Larry Kudlow – Economic analyst, commentator and syndicated columnist

Administration Priorities

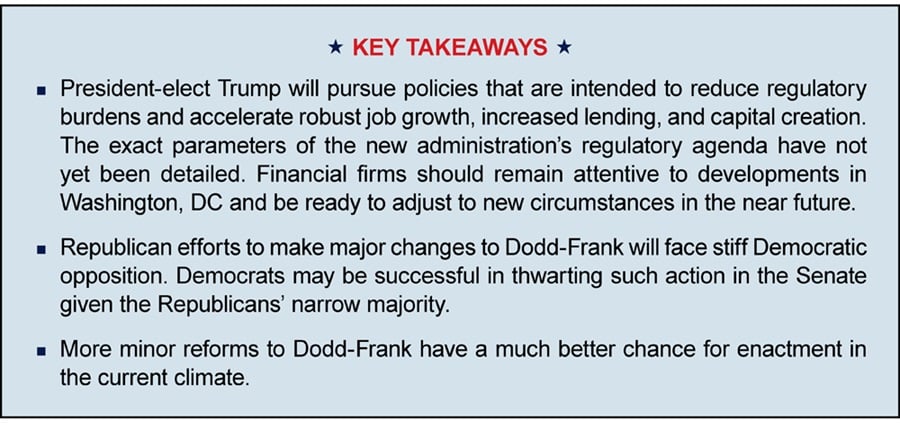

President-elect Trump has not announced a specific agenda for the regulation of the financial services industry. As with other sectors of the economy, the Trump Administration likely will follow a general de-regulatory policy that is focused on allowing businesses to expand and increase hiring. Indeed, the President-elect has committed to repealing or at least reforming the Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act). With respect to regulatory policy, the Trump Administration will begin with an effort to identify wasteful and unnecessary regulations that impede job growth and that can be eliminated. The following describes specific areas that may be targeted for reform and provides a general overview of the new administration's approach toward the financial sector.

General Regulatory Atmosphere. President-elect Trump likely will afford broader latitude for financial firms to provide their services. Financial institutions may anticipate that the growth of regulatory initiatives to slow substantially. This is particularly the case in areas where regulation is perceived to delay economic growth. In a similar vein, the new administration would likely advance a more balanced enforcement policy. As a candidate, President-elect Trump especially criticized the Consumer Financial Protection Bureau (CFPB) and its extensive enforcement agenda. Even if the new administration cannot abolish the CFPB, it will discontinue the Obama Administration's aggressive pursuit of enforcement actions by the agency and other regulators. The new administration will not rely on "disparate impact" theories in enforcement litigation.

Systemic Regulation. The new administration's policies as to the scope and scale of financial regulation may be shaped by fallout from ongoing inquiries into misconduct at large institutions. The Republican Party platform, however, included a surprising goal of reinstating the Glass-Steagall Act. If the Republican Congress achieves this goal, then there will be calls for a fundamental re-evaluation of a host of regulations adopted since 1999.

The new administration will take its own tack and not defer to international banking groups, such as the Financial Stability Board (FSB), with respect to systemic regulation and "shadow banks" (financial companies that are not banks). This will likely make the administration take a more measured approach toward implementing any new capital, margin, or collateral requirements that are advocated by the FSB, the Basel Committee on Banking Supervision, or International Monetary Fund. The new administration is likely to resist changes to US financial regulations unless changes are simultaneously implemented in comparable form by other financial centers.

Housing Finance. The status of Fannie Mae and Freddie Mac remain open questions. The Government-Sponsored Enterprises remain in conservatorship, and currently pay nearly all of their earnings to the federal government. It is thought that the President-elect may embrace proposals to transfer their portfolios and businesses entirely to the private sector or to create a new entity that would perform similarly to the Government-Sponsored Enterprises, albeit in a more limited fashion. In the meantime, the new administration will seek to make rental housing and home ownership more affordable by decreasing regulatory burdens for real estate developers, rental housing providers, and the real estate markets in general. It also will seek to increase banks' willingness to provide housing finance by reducing the burdens associated with CFPB rules and the likelihood of CFPB enforcement actions.

Financial Crimes, System Security, and Technology. Certain regulatory priorities are expected to remain in place and possibly enhanced. Financial regulatory agencies will likely continue to expect that institutions maintain and enforce strong anti-money laundering programs. Cyber-security also will continue as a high priority as threats in this area increase. Regulators will pay significant attention to cyber-preparedness when examining any financial institution. Regulators also will assess how new technologies may be incorporated into the financial system. For example, the Comptroller of the Currency will continue its consideration of a new limited-purpose charter for "fintech" companies.

AGENCY LEADERSHIP

The Trump Administration is expected to be heavily-populated by non-career politicians with substantial ties to business and the financial sector. The Treasury Secretary position is no exception. The President-elect is expected to nominate Steve Mnuchin, former Goldman Sachs partner and co-founder of hedge fund Dune Capital Management. Other rumored picks for the post currently include:

- Larry Kudlow, economic analyst, commentator, and syndicated columnist

- Bob Corker, US Senator from Tennessee

- Carl Icahn, investor, founder of Icahn Enterprises

- Henry Kravis, co-founder of private equity firm KKR & Co.

- Jack Welch, former CEO of General Electric

CONGRESSIONAL LEADERSHIP

House. Rep. Jeb Hensarling (R-TX) will remain chairman of the House Financial Services Committee, a position he has held since 2013. Chair Hensarling has been a vocal critic of the Dodd-Frank Act and has pursued (generally unsuccessfully) a number of changes to the law since its enactment. His Democratic counterpart on the committee will once again be Ranking Member Rep. Maxine Waters (D-CA).

Senate. Sen. Michael Crapo (R-ID) will likely be the new chair of the Senate Banking Committee, as the outgoing chair, Sen. Richard Shelby (R-AL), is term-limited. Sen. Crapo previously served as ranking member of the committee from 2013-2014. Sen. Sherrod Brown (D-OH) will remain as ranking member of the committee.

CONGRESSIONAL PRIORITIES

With the Republicans retaining control of Congress and seizing the White House, we expect that Chair Hensarling and the House Financial Services Committee will continue to revisit proposals to scale back Dodd-Frank Act reforms. The Senate Banking Committee will follow suit to some extent, but will be more susceptible to pushback from Sens. Brown and Elizabeth Warren (D-MA). Both Senators will fight attempts that they believe will weaken Dodd-Frank at both the committee level and on the Senate floor, where procedural rules give the minority greater ability to obstruct or at least delay action.

It is likely that the Senate will be ground zero for Democratic efforts to block action on GOP priorities. The Republicans' narrow majority in the Senate, combined with procedural rules that give the minority party substantial power, mean that Democrats will be able to obstruct certain policy measures. The dynamics may be similar to what Senate Republicans did in the first two years of the Obama Administration. Thus, the possibility of major reforms to Dodd-Frank, while greater given next year's unified Republican control, is tempered by the narrow margin they hold in the Senate.

Dodd-Frank Overhaul. The opening salvo from Republicans happened when Chair Hensarling introduced his plan to replace Dodd-Frank earlier this year in the form of his Financial CHOICE (Creating Hope and Opportunity for Investors, Consumers and Entrepreneurs) Act. With full knowledge that there is no chance for enactment in this Congress, the bill was clearly intended to set the table for 2017 by defining the parameters of the financial regulatory reform debate. Among the reforms included in the Financial CHOICE Act are:

- Repealing the FSOC's ability to designate Systemically Important Financial Institutions (SIFI). This would repeal the entirety of Title II of Dodd-Frank and add a new chapter to the bankruptcy code designed for large financial institutions.

- Establishing a voluntary "off-ramp" from Dodd-Frank regulation and Basel III standards for banks choosing to maintain certain capital standards.

- Eliminating the Volcker Rule.

- Replacing the CFPB with a 5-member commission subject to Congressional oversight.

- Abolishing the Office of Financial Research.

- Reauthorizing and reforms the Securities and Exchange Commission for 5 years.

- Repealing the Department of Labor's Fiduciary Rule.

- Repealing the entirety of Title VIII of Dodd-Frank (Financial Market Utility Designations).

- Repealing the Chevron deference doctrine for financial regulators.

- Requiring cost-benefit analyses for financial regulations.

- Imposing greater congressional oversight of financial regulators' appropriations.

These reforms represent a laundry list of Republican priorities and will have varying prospects for success in the coming Congress. Senate Democrats may well be able to block many of these reforms.

Volcker Rule/Incentive Compensation Limits. Republicans have made no secret of their desire to overturn the Volcker Rule as well as remove the incentive compensation limits under Section 956 of the Dodd-Frank Act. Both of these priorities were included in Chair Hensarling's Financial CHOICE Act that was adopted by the Financial Services Committee (along near-party lines) in September. Republicans, however, would need to convince a number of Senate Democrats to join them on this effort to overcome a likely Democratic filibuster, and their ability to do so remains to be seen.

More incrementally, Federal Reserve Chair Janet Yellen, in testimony before the House Financial Services Committee on September 28, expressed support for exempting community banks from the Volcker Rule and from the incentive compensation limits under section 956 of Dodd-Frank. There has been some bipartisan agreement on the need for relief for community banks, and it is possible that action in this area could be pursued. While we expect that the progressive wing of the Democratic Party will push back on any such changes, some relief for community banks remains possible. Trump is unlikely to support anything Elizabeth Warren is pushing.

Consumer Financial Protection Bureau. Congressional Republicans, with Rep. Hensarling chief among them, have long criticized what they describe as the CFPB's nearly unlimited power. They will undoubtedly continue efforts to curtail its authority under the Trump Administration. Two developments in particular will embolden Republicans on this front. First, the ongoing investigations of Wells Fargo have already provided an opening for Republicans to say that the CFPB was asleep at the switch, and we expect that this line of criticism will continue in the new Congress. Second, the recent DC Circuit Court decision holding that the CFPB's structure is unconstitutional (while allowing it to continue operating with a director that can be removed without cause) will ensure continued focus on the Bureau's future.

$50 Billion Threshold for Enhanced Supervision of Bank Holding Companies. A number of members of Congress, particularly Republicans, have advocated for raising the current threshold of $50 billion in assets for bank holding companies to be subject to enhanced prudential supervision under Dodd-Frank. Legislation aiming to do that (among other Dodd-Frank reforms) was marked up in the Senate Banking Committee in 2015, but thus far the bipartisan consensus needed to enact such reforms has proven elusive. Still, Federal Reserve Board Governor Daniel Tarullo has specifically advocated raising the threshold, and Federal Reserve Chair Yellen has signaled an openness to it as well.

Wells Fargo. If there has been any area of financial services policy where partisan lines have virtually disappeared, it has been in the investigation of Wells Fargo's unauthorized accounts. We expect that congressional investigations will continue into 2017, and it is conceivable that the probe could widen its focus to other banks if there is evidence of similar incentive structures to those that drove the Wells Fargo scandal.

To be sure, partisanship will return as the discussion turns to how to prevent such fraud in the future. Chair Hensarling has already used the scandal to attack the CFPB, while Democrats have used it to criticize the Financial CHOICE Act. For now, we can expect a fair amount of cooperation until the investigation concludes.

Glass-Steagall. The Democratic National Committee supported adopting an updated and modernized version of Glass-Steagall in its platform. The surprising inclusion in the Republican National Committee platform of reinstating Glass-Steagall has raised numerous eyebrows in the financial services sector, but it remains to be seen whether such a proposal would have any chance in the 115th Congress. We view its inclusion there largely as a product of new participants in the platform process who reflect the populist bent that fueled the Trump candidacy. It remains to be seen whether the parties can work together on such legislation.

Our full analysis of the 2016 election is available below.