Control and Beneficial Ownership Disclosure Requirements for Domestic and Foreign Entities Doing Business in the District of Columbia

Effective January 1, 2020, the DC Council amended1 existing filing requirements2 in the District of Columbia (DC) to require that (i) all newly formed domestic entities and (ii) all foreign entities registering to do business in DC, disclose to the Department of Consumer and Regulatory Affairs (DCRA) the identity and other information of (1) certain direct or indirect beneficial owners of such entity and (2) certain 'controlling' parties of such entity (collectively, the Initial Amendment).

Effective March 14, 2020, pursuant to an additional amendment (as further amended, the Amended Filing Requirements)3, the DC Council clarified that the new disclosure requirements also apply to 'foreign' owners in the registering entity’s chain of ownership, eliminating a potential hole in the requirements that could have arguably exempted entities registered in Delaware or other foreign jurisdictions from complying with the new disclosure requirements. The Amended Filing Requirements now require companies to disclose publicly much more information than previously requested, including information that many companies view as confidential. Additionally, such requirements impose stiff sanctions for violations, which could have significant ramifications for those doing business in DC.

Overview of the Requirements

The purpose of the revised requirements was, in part, to prevent landlords from maintaining residential properties below acceptable standards and later anonymously hiding behind the entity owning the real property.4 The Amended Filing Requirements, however, apply to all entities in DC (such as corporations, limited liability companies, partnerships, nonprofit corporations and unincorporated nonprofit associations)5, and not just those engaged in the ownership and operation of residential real estate.

The Initial Amendment to the DC Code expanded §29-102.01 to require that entities filing for a new domestic or foreign registration (or for existing entities, submitting mandatory biennial reports to DCRA), provide the (i) name, (ii) residence and (iii) business address of each person whose:

(6) . . . aggregate share of direct or indirect, legal or beneficial ownership of a governance or total distributional interest of the entity:

(A) Exceeds 10%; or

(B) Does not exceed 10%, provided, that the person:

(i) Controls the financial or operational decisions of the entity; or

(ii) Has the ability to direct the day-to-day operations of the entity.

The later enacted Amended Filing Requirements were drafted to ensure compliance by foreign entities and clarify that, they too, need to undergo the same analysis. The added provision provides that such entities will also be required to provide the (i) name, (ii), residence and (iii) business address of each person whose:

(7) . . . aggregate share of direct or indirect, legal or beneficial ownership of a governance or total distributional interest of the foreign entity:

(A) Exceeds 10%; or

(B) Does not exceed 10%, provided, that the person:

(i) Controls the financial or operational decisions of the foreign entity; or

(ii) Has the ability to direct the day-to-day operations of the foreign entity.

In a prior version to the Amended Filing Requirements6, the Council specifically stated their 'rationale' for such amendment was to clarify the Council's intent to ensure businesses incorporated outside of DC, that have an ownership interest in entities doing business in DC, disclose the required ownership information to the DCRA.

Potential Consequences

Significant consequences may now exist for entities that fail to meet the requirements of the Amended Filing Requirements. D.C. Code §29-102.06 currently provides, as it did prior to the enactment of the Amended Filing Requirements, that if DCRA rejects an entity’s filing based on an inaccuracy, the entity will have the opportunity to amend and refile (the Refiling Provision).7 However, the newly added D.C. Code § 29-102.01(8) now provides that an entity that does not include the identity and other information required by paragraphs (6) and (7) of such Section will not be allowed to register or conduct business in DC.8 It is not clear from the Amended Filing Requirements or legislative history whether the DC Council intended to make a failure to comply with the new disclosure requirements a fatal flaw that cannot later be corrected, or whether new paragraph (8) simply means that such filings will also be rejected, but may be corrected as otherwise set forth in D.C. Code §29-102.06. Until DCRA issues further guidance, entities should assume that the harsher penalty under D.C. Code §29-102.01(8) could control, and that entities will not be granted an opportunity to refile for failure to disclose the applicable direct or indirect owners. Further, the Amended Filing Requirements provide that a domestic entity that does not include the required information in its biennial reports may be administratively dissolved and, similarly, a foreign entity's registration may be terminated.9

The result of a failure to comply with the new amendments, of course, goes beyond potential exposure to statutory penalties. If entities are dissolved, for example, a borrower is likely to risk defaulting under typical loan documents which require the record owner of real property to remain registered at all times to do business in DC. Given the subjective nature of whether the requested information has been 'properly' disclosed, and without knowing whether DC will require supporting evidence (including otherwise highly confidential organizational documents), the Amended Filing Requirements present a significant concern.

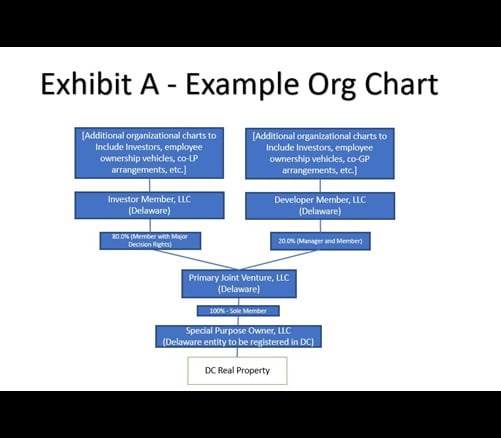

Moving forward, companies should explore these issues before registering to conduct business or filing biennial reports in DC. A sample organizational chart for a real property owning limited liability company required to register in DC, and some of the questions raised thereby, can be found on Exhibit A below.

Additional Thoughts

- Our assumption is that the filing entity (Special Purpose Owner, LLC) is required to report each owner meeting the requirement of D.C. Code § 29-102.01, which would include all applicable entities going up the chain of ownership. In the above example, this would mean that at least (i) Primary Joint Venture LLC, (ii) Developer Member and (iii) Investor Member would be considered a greater than 10% owner. In a typical deal structure, additional persons or entities on the Investor Member side (and possibly on the Developer Member side) would also meet this test.

- The concept of control in paragraphs (6) and (7) of D.C. Code § 29-102.01 is broad enough to cause confusion when analyzing entities acquiring commercial real properties in DC (including REIT subsidiaries or other large commercial real estate developers), which typically have complex organizational structures. The control test raises additional questions, including:

A. If Developer Member is designated as the Manager in the Operating Agreement of Primary Joint Venture, LLC, does only Developer Member report control, or should Investor Member report control as well if it retains so-called Major Decision control?

B. Does each entity in the chain with ‘control’ over the primary joint venture members also have to report having control? In other words, would the control test be reviewed in the same manner as the ownership test (where control is tested at every level of the chain of ownership)?

*Alyson Larkin contributed to this Advisory. Ms. Larkin is a graduate of The George Washington University School of Law and is employed at Arnold & Porter's Washington, DC office. Ms. Larkin is admitted only in Maryland. She is not admitted to the practice of law in Washington, DC.

© Arnold & Porter Kaye Scholer LLP 2020 All Rights Reserved. This Advisory is intended to be a general summary of the law and does not constitute legal advice. You should consult with counsel to determine applicable legal requirements in a specific fact situation.

-

D.C. Law 22-287. Department of Consumer and Regulatory Affairs Omnibus Amendment Act of 2018.

-

See generally D.C. Code § 29-102.01.

-

D.C. Act 23-203. Fiscal Year 2020 Budget Support Clarification Amendment Act of 2020.

-

Katie Arcieri. "D.C. Council approves bill to unmask individuals behind all LLCS." Washington Business Journal, 18 December 2018; Kati Arcieri. “D.C. bill would unmask individuals behind landlord, developer LLCs." Washington Business Journal, 24 July 2018.

-

-

Bill 23-504. Fiscal Year 2020 Budget Support Clarification Amendment Act of 2019.

-

-

Fiscal Year 2020 Budget Support Clarification Amendment Act of 2020. § 29-102.01(a)(8).

-

Fiscal Year 2020 Budget Support Clarification Amendment Act of 2020. § 29-102.11(8).