Post-Election Analysis 2016: Budget & Appropriations

ADMINISTRATION PRIORITIES

President-elect Trump will face several fiscal challenges, including how he will fund defense and non-defense discretionary spending, addressing growth of mandatory spending programs – including major entitlement programs, such as Medicare and Social Security – and finding the revenue to offset increased discretionary spending. The Trump Administration's FY 2018 budget proposal will outline a blueprint of his federal funding priorities and revenue plans. It also will provide insight into the administration's vision for addressing the landscape of fiscal challenges the country faces both short- and long-term. The first budget proposal will be a significant marker for how the administration will approach changing the trajectory of federal debt. President-elect Trump's budgetary and tax proposals drew heavy skepticism from economists and fiscal conservatives during the campaign season over their large projected deficits. As a result, a revised version was put forth in September 2016, following significant criticism on its lack of specificity and conflicting fiscal positions.

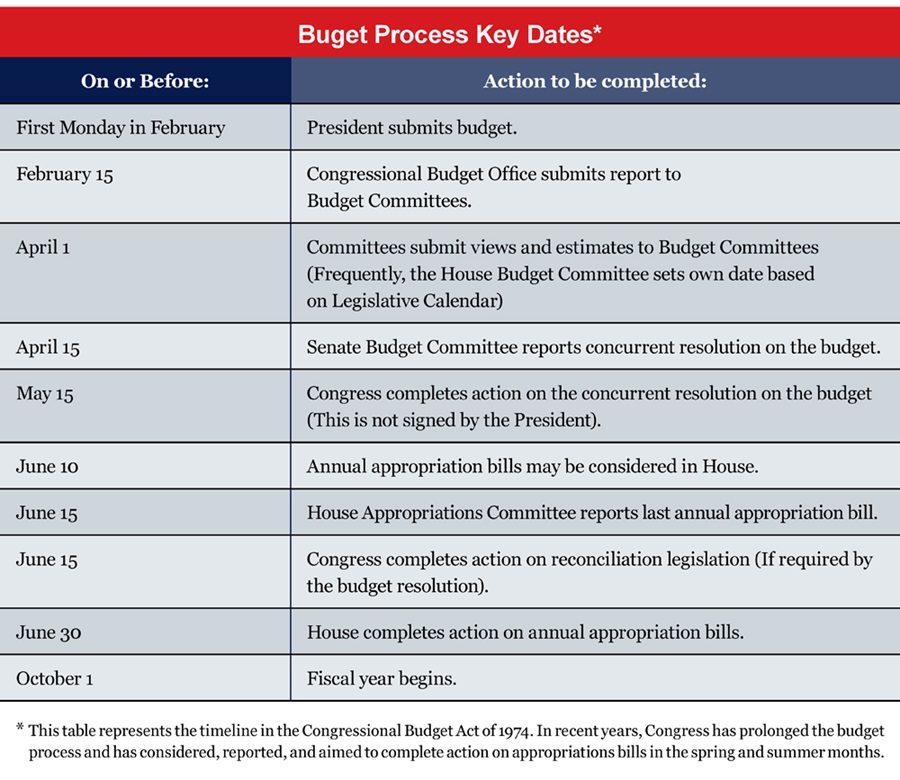

During the first year of a new administration, it is unlikely the President-elect will adhere to the budget timeline due to the presidential transition process. We expect the administration to release a less detailed outline of his FY 2018 budget proposal after the first Monday in February (February 6) deadline, followed by a more detailed version of the budget later in the year (likely by April or May). The Office of Management and Budget (OMB) plays a central role in the presidential transition process, so President-elect Trump will likely select an OMB director shortly after the election who will be involved in helping with the preparation process for the FY 2018 budget even prior to the presidential inauguration. Robert Grady, a former OMB Associate Director under the George H.W. Bush Administration has been mentioned as a potential OMB director.

President-elect Trump's budgetary priorities focus on making large investments in defense and marginal discretionary spending increases in a few key areas, coupled with a mix of lower tax rates he hopes will yield more economic activity to generate higher tax revenues and select discretionary funding cuts. However, the administration's success largely will depend on finding common ground with Congress. Additionally, the President-elect's spending priorities will face intense resistance from congressional Democrats, who will focus on obstructing passage of unpalatable priorities, and other third-party stakeholders such as think tanks and associations.

Discretionary and Defense Spending. During the campaign, President-elect Trump proposed drastically increasing spending on defense, veterans, and border control, while walling off reforms to federal entitlement programs. Some of the proposed spending priorities include:

- Defense. President-elect Trump has called for increasing defense spending by $450 billion over a decade, including escalating spending on defense procurement, modernizing missile defense systems and Navy cruiser ships, and increasing military troop levels.

- Cuts. President-elect Trump has proposed cutting non-defense and non-entitlement programs (Social Security and Medicare) through the appropriations process by 1 percent each year for a decade to save one trillion dollars. Conversely, there are some agencies where he has proposed spending increases, such as the Department of Homeland Security's Customs and Border Protection Agency and the Department of Veterans' Affairs.

- Immigration. President-elect Trump will aim to secure increased investments in border security funding and hiring 5,000 additional border patrol agents and tripling deportation officers. This would represent a 24 percent increase in authorized jobs.

Revenues. During the campaign, the President-elect proposed a comprehensive tax overhaul plan, similar to congressional Republican tax reform proposals of the past, but on a much larger scale. Under President-elect Trump's tax plan, he proposes lowering tax rates for individuals and corporations, closing tax loopholes, and scaling back deductions. Details on whether the tax cuts will be paid for is unclear and initial estimates are that his tax plan may reduce revenue by approximately 4 to 6 trillion dollars over the next decade (not accounting for any increased revenue from economic growth as a result of the tax cuts).

Sequestration. President-elect Trump will attempt to end the sequester of across-the-board spending cuts on defense programs only, which are scheduled to be reinstated in 2018. However, eliminating the sequester will cost an estimated $560 billion over ten years. Trump has not indicated specific pay-fors; however, he has suggested he would fully offset the costs through "common sense reforms that eliminate government waste and budget gimmicks." The two-year budget agreement reached by Speaker Paul Ryan (R-WI) and Sen. Patty Murray (D-WA) in 2015, which provided temporary relief from deep budget cuts through sequestration, will expire in 2017 and once again will set up a large budget battle between the administration and Congress. Congressional Democrats will push strongly for ending sequestration cuts on domestic spending as well, though they will have limited leverage in the Republican-controlled Congress.

CONGRESSIONAL LEADERSHIP

House. Rep. Hal Rogers (R-KY) is term-limited as chair of the full House Appropriations Committee and has announced his intention to seek the top seat on the Subcommittee on Defense. The current Subcommittee on Defense Chair, Rep. Rodney Frelinghuysen (R-NJ) is favorited to become the next full Committee chair. The Subcommittee on Financial Services Chair, Rep. Ander Crenshaw's (R-FL) retirement will open up the top position for Rep. Tom Graves (R-GA) to replace him. Rep. Graves, who currently serves as chair of the Subcommittee on Legislative Branch, is second in seniority on Financial Services. On the Democratic side, Rep. Nita Lowey (D-NY) is expected to remain as ranking member of the full House Appropriations Committee. Rep. Rosa DeLauro (D-CT) is expected to replace Rep. Sam Farr (D-CA), who is retiring, as the ranking member of the Subcommittee on Agriculture, Rural Development, Food and Drug Administration, and Related Agencies. While the Appropriations Committee is expected to see significant movement within its leadership positions, only two retiring members will be departing the committee.

Rep. Tom Price (R-GA) will remain as chair of the House Budget Committee in the 115th Congress. Rep. Chris Van Hollen (D-MD), who was elected to the Senate will be replaced by Rep. John Yarmuth (D-KY) as the ranking member of the committee.

Senate. Sen. Thad Cochran (R-MS) will remain chair of the Senate Appropriations Committee. Sen. Patrick Leahy (D-VT) has indicated his intention to take over the ranking member spot, trying to fill the shoes of Sen. Barbara Mikulski (D-MD), who will be retiring this year. Her retirement will also open up the ranking member position on the Subcommittee on Commerce, Justice, Science and Related Agencies, and Sen. Mark Kirk's (R-IL) loss will open up the chair position on Military Construction and Veterans Affairs.

Sen. Mike Enzi (R-WY) is expected to remain serving as the chair of the Budget Committee where he will continue to push for his budget overhaul bill. Sen. Bernie Sanders is expected to remain the top Democrat on the Committee.

CONGRESSIONAL PRIORITIES

Although the congressional ban on earmarks has made serving on the Appropriations Committee generally less attractive in recent years, the dysfunction in which Congress has continued to operate and the level of gridlock in the past few Congresses has driven more policymaking into the appropriations process. As fewer legislative authorizing packages are passed, members who sit on the appropriations committees have gained increasingly more relevance in policy debates.

The Budget Process. House Speaker Paul Ryan will once again attempt to restore "regular order" to the budget process in the new Congress. As a former Budget Committee Chair, Speaker Ryan will continue to make it a top priority for the House to pass a budget resolution and allow the 12 separate appropriations bills to be considered, passed and conferenced individually through regular order, instead of passing short- or long-term continuing resolutions and larger omnibus spending packages at the end of the fiscal year or later. However, even with a Republican-controlled Congress in the 114th Congress, Republicans were forced to abandon regular order as divides within the party fractured their ability to pass a budget that met the demands of some of the most conservative wing of the House GOP caucus. In the 115th Congress, House Republicans will face continued resistance in their own party over any budget deal which doesn't meet the approval of conservatives. House Freedom Caucus and Republican Study Committee members opposed their party's efforts to pass a FY 2017 budget because it did not make deep enough cuts. Nevertheless, we expect President-elect Trump to see the budget as an opportunity to improve relations with Speaker Ryan, by allowing Ryan to be the driving force in Washington on budget reform issues.

Though Congressional Democrats will have little leverage in the 115th Congress, the fact that they have picked up a few Senate seats will allow them to have a strong voice in: (1) passing FY 2018 spending bills; (2) reaching a new budget deal with a Trump Administration; and (3) addressing the debt ceiling. The Senate Democrats will be the leading check on proposed budget reforms coming from Speaker Ryan and the House.

Budget Overhaul. With a Republican-controlled Congress and administration, congressional Republicans may have the opportunity to enact an overhaul to the budget process. Proposals to change the Budget Act of 1974 (Pub. L. 93-344) have been long proposed by Republicans in previous Congresses. House Budget Committee Chairman Rep. Tom Price and his Senate counterpart, Sen. Michael Enzi, worked on proposals expected to be released before the end of 2016, and which will likely be re-introduced for consideration in the 115th Congress. Their preliminary proposals would change the budget from a one-year to a two-year cycle and would aim to establish long-term fiscal targets to control spending. With a Republican controlled Senate and administration, the Senate could employ budget reconciliation procedure without needing 60-votes to expedite the passage of budget-related legislation in the Senate. Proposals to reform the budget process have enjoyed bipartisan support in Congress, however, any such attempt to alter the budget will receive resistance from members of both parties who sit on the appropriations committees.

Debt Limit. Congress will have to address the debt limit shortly after the start of the 115th Congress. The federal debt limit cap was suspended through mid-March 2017 following the passage of the Bipartisan Budget Act of 2015. The Treasury may use available extraordinary measures allowing the government to borrow to pay for federal obligations until mid-summer 2017. Congressional Democrats will use the debt limit in an attempt to force policy concessions from the Trump Administration, as Republicans have done in the past with the Obama Administration. However, it is unclear if this will be a viable negotiating tactic for Democrats, given President-elect Trump's conflicting statements on how he will address the issue of raising the debt limit. Congress will not reach an agreement on the debt ceiling until forced to do so up against the March or June deadlines.