Post-Election Analysis 2016: Antitrust

ADMINISTRATION PRIORITIES

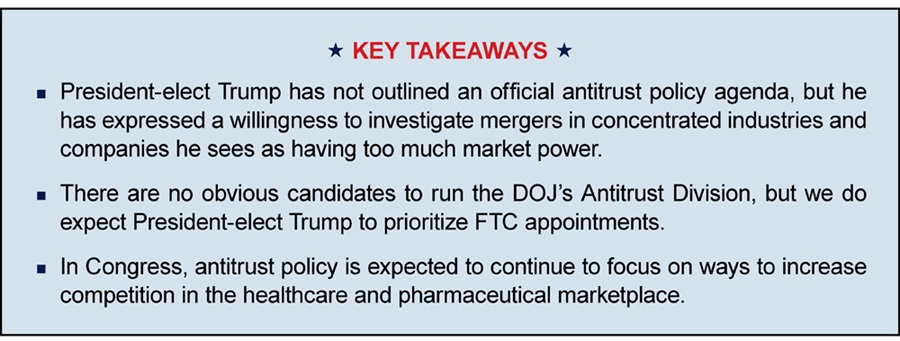

President-elect Trump's campaign has addressed the topic of antitrust enforcement in specific instances; however, President-elect Trump has not outlined a formal antitrust policy agenda. He has campaigned in part on the notion that the economy is "rigged" but has not made clear if or how that view may affect antitrust enforcement more broadly.

Therefore, it is difficult to extrapolate whether the Trump Administration will follow a more traditional Republican approach, which in recent years has been somewhat less enforcement-oriented than the approach of Democratic administrations, or whether perhaps it will be more enforcement-minded in general, or just with regard to certain industries, such as the media.

No matter what the overall approach, it is important to keep in mind that there are institutional limitations with regard to the magnitude of any shift in enforcement policy. The antitrust agencies are not regulatory agencies – they are law enforcement agencies, and their actions are eventually reviewed by federal courts. The Department of Justice (DOJ) cannot "block" a transaction – it can only challenge it, in court, though the threat of a court challenge is often all that's needed to derail a proposed combination. The Federal Trade Commission (FTC) is an administrative agency and thus can seek to litigate against transactions or unilateral conduct within the FTC administrative process (and the FTC does have some additional flexibility based on its authority under Section 5 of the FTC Act), but those decisions, too, are eventually subject to federal court review.

In this context, the Trump Administration can more easily step back than step forward – i.e., less aggressive agency enforcement policy can allow more deals and more conduct to go unchallenged, and in that sense if the administration desires a less aggressive enforcement policy it can be implemented. A more aggressive policy also can be implemented, but such an approach has its limits – certainly more aggressive enforcement by the agencies can (and does) change the risk calculus for potential deals and can extend the time needed for deals to be consummated – and the approach of the agencies is a very significant issue that can change the economics associated with a deal. However, antitrust agencies cannot, merely by virtue of more aggressive review, whether in general or within a particular industry, fundamentally re-write the antitrust laws; the agencies need to win in court to make fundamental changes in the way the antitrust laws are applied. Of course, this does sometimes happen (i.e., F.T.C. v. Actavis, Inc.), and it is more likely to happen if the agencies are very aggressive in their enforcement efforts, but merely planning to be aggressive does not in and of itself dictate a change in legal outcomes.

AGENCY LEADERSHIP

Department of Justice. President-elect Trump campaigned aggressively against those he considers to be "Washington insiders" so his administration may be reluctant to appoint someone with previous high-level agency experience to lead the DOJ Antitrust Division.

Federal Trade Commission. The FTC finds itself in an unusual situation, because only three of five commissioners – the Chair Edith Ramirez (D) and Commissioners Terrell McSweeny (D) and Maureen K. Ohlhausen (R) – are currently serving. Once President-elect Trump takes office, he would presumably name Commissioner Ohlhausen as acting Chair (if Commissioner Ohlhausen is chosen by the administration to be the permanent Chair, she would need to be confirmed in that position, and thus could only be acting chair in the interim), and Chairwoman Ramirez would revert to being a commissioner. This would create an odd situation where the acting chair is a Republican appointee but the Democratic appointees constitute a majority on the Commission. The Commission can function this way – under Commission rules, a majority of the members of the Commission (1) in office and (2) not recused from participating in a matter constitutes a quorum for the transaction of business in that matter. So the FTC will be able to conduct business and take enforcement actions on 2-1 votes or even on 2-0 votes, in instances where one commissioner is recused. But the chair will be in the minority. Even if Chair Ramirez were to leave, which she is generally expected to do, Commissioner McSweeny would still maintain an effective veto. In either scenario, this would leave the Republican President with a Commission controlled by Democrats, and the potential for deadlock or for the Democratic commissioners to outvote the acting chair means that the Trump Administration will prioritize nominations for the open Commission seats. With a Republican Senate, that will likely be completed swiftly.

CONGRESSIONAL LEADERSHIP

House. Rep. Tom Marino (R-PA) is expected to continue to chair the House Judiciary Subcommittee on Regulatory Reform, Commercial and Antitrust Law. This will be Rep. Marino's second term as the subcommittee chair. Rep. Hank Johnson (D-GA), who has been ranking member of the subcommittee since 2013, also should retain his post.

Senate. Sen Mike Lee (R-UT), is likely to have his second term as chair of the subcommittee, and Sen. Amy Klobuchar (D-MN) should remain subcommittee ranking member.

CONGRESSIONAL PRIORITIES

With the national attention given to dramatic increases in the price of drugs in recent years, antitrust policy is expected to continue to focus on ways to increase competition in the healthcare and pharmaceutical marketplace. Both the House and the Senate committees, as well as President-elect Trump, have addressed the rising cost of drugs. The House Judiciary Subcommittee on Regulatory Reform, Commercial and Antitrust Law has examined the role of Pharmacy Benefit Managers (PBMs) and health insurance companies and consolidation in those sectors, and can be expected to continue oversight on mergers and potentially anticompetitive actions that have an impact on the cost of healthcare. As part of his health care plan, President-elect Trump also has indicated support for repeal of the McCarran-Ferguson Act, which currently provides insurance companies with a certain degree of exemption from federal antitrust laws.

Separately, the Republican leaders on the House subcommittee have expressed concern regarding the discrepancy between the litigation process and standards applied to FTC litigation, and litigation by DOJ antitrust enforcement policies. In 2016, the House passed the Standard Merger and Acquisition Reviews Through Equal Rules Act (H.R. 2745), which seeks to standardize the process by which the FTC and the DOJ pursue action against proposed mergers, and this topic could remain a priority for the Republican-led House and Senate subcommittees. Another topic that could receive greater attention is international antitrust, with the subcommittees focusing on China's antitrust policies and their impact on US markets.

Pay for Delay. Sen. Klobuchar, along with Senate Judiciary Chair Chuck Grassley (R-IA), introduced the Preserve Access to Affordable Generics Act (S. 2019) in the 113th and 114th Congresses. This legislation, a priority for both senators, would impact the ability of pharmaceutical companies that produce brand-name drugs to reach patent settlement deals with generic companies that delay competition from those generic competitors. Sens. Klobuchar and Grassley have called this practice anticompetitive, and have taken the position that such patent-settlement deals artificially inflate drug prices. Given the recent attention on drug prices, both in the public and in Congress, it is likely that this legislation will be a continued priority.

Risk Evaluation and Mitigation Strategy. The bipartisan leaders of both the full Senate Judiciary Committee and the Antitrust, Competition Policy and Consumer Rights Subcommittee introduced The Creates Act (S. 3056), aimed at increasing generic competition for pharmaceutical drugs. The bill addresses the Risk Evaluation and Mitigation Strategy program (REMS), which is designed to ensure that high-risk drugs are dispensed safely to patients, but which the sponsoring senators argue has been used by brand-name drug companies to prevent potential generic competitors from obtaining drug samples needed as part of the generic development process. The bipartisan nature of this legislation, and the focus on drug pricing, mean that this issue will likely continue to receive attention in the Judiciary Committee next Congress.

Our full analysis of the 2016 election is available below.