FTC Raises Both Hart-Scott-Rodino Premerger Filing and Interlocking Directorate Thresholds and Introduces a New Filing Fee Structure

On January 23, 2023, the Federal Trade Commission (FTC) announced its annual revision of the filing thresholds under the Hart-Scott-Rodino Antitrust Improvements Act (HSR Act), increasing the minimum reportable transaction from $101 million to $111.4 million. The FTC also announced revisions to thresholds relating to prohibitions on interlocking directorates under Section 8 of the Clayton Act.

HSR Reporting Threshold

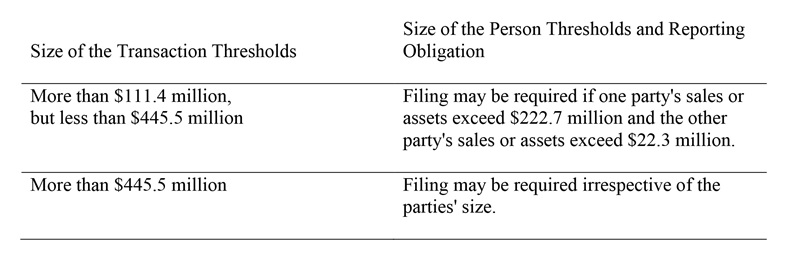

Under the HSR Act, parties may be required to file notification for various acquisitions of voting securities, assets, and noncorporate interests with the FTC and Department of Justice (DOJ) and observe a waiting period before closing. The thresholds for filing are revised annually to adjust for inflation. The size of transaction and size of person thresholds were also increased.

Filing Fees

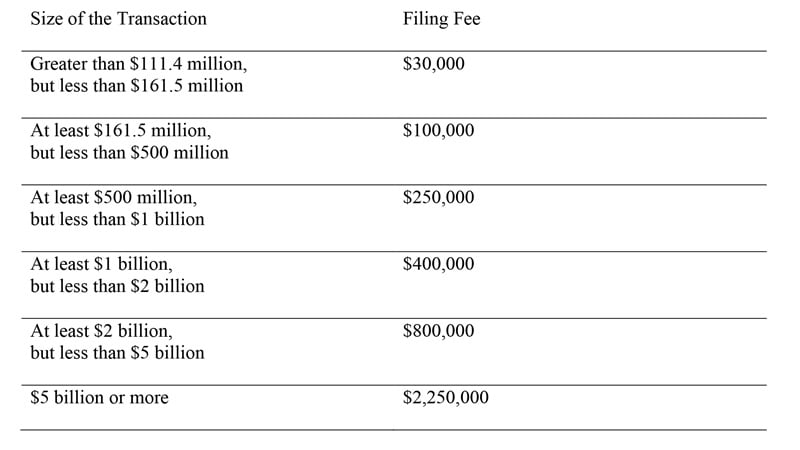

On December 29, 2022, President Biden signed into law H.R. 2617, otherwise known as the Consolidated Appropriations Act, 2023 (Appropriations Act), which includes the Merger Filing Fee Modernization Act of 2022 (2022 Amendments). The 2022 Amendments revise the Hart-Scott-Rodino Act premerger notification filing fees. The filing fees have not been adjusted for inflation since 2001. The existing three filing fee tiers are being replaced by six filing fee tiers. Although the filing fee for smaller transactions has been reduced from $45,000 to $30,000, the filing fees have increased substantially for transactions valued above $1 billion. Beginning in fiscal year 2024, the filing fee tiers will be adjusted annually to reflect changes in the GNP for the previous year. Also, beginning in fiscal year 2024, the 2022 Amendments will require the filing fees to be increased annually if the percentage increase in the consumer price index (CPI) for the prior year, as compared to the CPI for the fiscal year ending September 20, 2022, is greater than one percent.

Beginning in fiscal year 2024, the filing fee tiers will be adjusted annually to reflect changes in the GNP for the previous year. Also, beginning in fiscal year 2024, the 2022 Amendments will require the filing fees to be increased annually if the percentage increase in the consumer price index (CPI) for the prior year, as compared to the CPI for the fiscal year ending September 20, 2022, is greater than one percent.

Clayton Act Section 8 Thresholds

New thresholds for the Clayton Act's prohibition on interlocking directorates were also announced. Section 8 of the Clayton Act makes it illegal, subject to certain exceptions, for a person to serve as a director or officer for two competing companies when the companies' profits or competitive sales exceed threshold limits.

Under the new thresholds, it is illegal for an individual to serve in these capacities for competing corporations if each company has capital, surplus, and undivided profits aggregating more than $45,257,000 (§ 8(a)(1)), unless one of the companies' competitive sales against the other are less than $4,525,700 (§ 8(a)(2)(A)) or other de minimis exemptions apply (§ 8(a)(2)(B) and (C)).

Effective Date

The revised HSR Act thresholds and adjusted filing fees will become effective on February 27, 2023. The revisions regarding interlocking directorates became effective immediately.

Disclosure of Subsidies From Foreign Adversaries

Section 201(b) of the Appropriations Act will require parties filing premerger notifications to include in their filings information concerning subsidies they receive from foreign entities of concern that pose a strategic or economic threat to the United States. Former US FTC Commissioner, Noah Phillips, who is a proponent of this legislation and is mentioned in the Appropriations Act, stated in an opinion article, co-authored with Congressman Scott Fitzgerald, “Like privately-owned companies, firms controlled by foreign governments can have the incentives and abilities to engage in anticompetitive conduct. They can also be deployed by the nations that own or control them to achieve ends not dictated by the normal incentives that companies face. That is, they may not be profit-maximizing.”

The legislation requires the FTC and DOJ to coordinate with the Chairman of the Committee on Foreign Investment (CFIUS), the Secretary of Commerce, and the Chairman of the US International Trade Commission, as well as other appropriate agencies, to implement the required disclosures.1 These disclosures will become required after the new rules are enacted.

Increase of the Civil Penalty for Violations of the HSR Act

The FTC also separately announced that the maximum civil penalty for violations of the HSR Act will increase from $46,517 to $50,120 per day. The increased civil penalty became effective on January 11, 2023. The new penalty level will apply to civil penalties assessed after the effective date, including civil penalties for which the associated violation predated the effective date.

© Arnold & Porter Kaye Scholer LLP 2023 All Rights Reserved. This Advisory is intended to be a general summary of the law and does not constitute legal advice. You should consult with counsel to determine applicable legal requirements in a specific fact situation.

-

Subsidies granted by governments—directly or through the intermediation of other companies, notably state-owned companies—are also an increasing area of public policy concern outside of the United States. In particular, the European Union’s Foreign Subsidies Regulation (Regulation (EU) 2022/2560 of the European Parliament and of the Council of 14 December 2022 on foreign subsidies distorting the internal market) that has entered into force on January 12, 2023 enables the European Commission to investigate whether subsidies granted by non-EU Member States distort the EU’s internal market. The Foreign Subsidies Regulation also introduces a mandatory filing and authorization regime for certain types of M&A transactions.