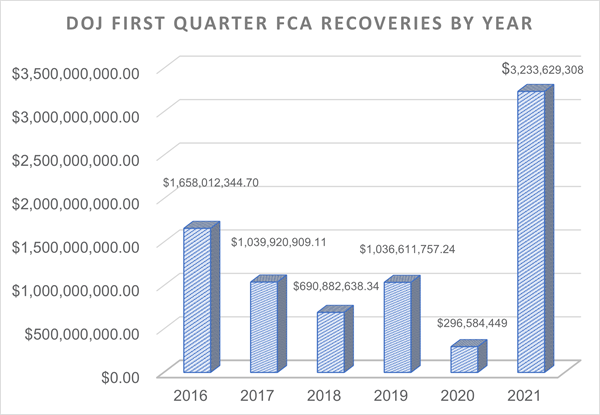

Lopsided Start To Fiscal Year 2021 Outpaces Total False Claims Act Recoveries From 2020

With the first quarter of Fiscal Year 2021 complete, the Department of Justice looks to be on pace for a banner year with respect to False Claims Act recoveries. DOJ recovered $3.23 billion in this quarter alone, which by our count (DOJ has not yet released its official statistics) is more than DOJ recovered in each of the three previous years. The vast majority of the quarter's haul can be attributed to two sizeable settlements accounting for more than 93% of the total amount recovered this quarter.

The driving force behind DOJ's record first quarter was an $8 billion global criminal and civil settlement with Purdue Pharmaceuticals, which resolved various allegations related to the company's manufacture and sale of opioids. The two settlements account for more than $3 billion in FCA recoveries—$2.8 million from the company and $225 million from shareholders of the company.

While "blockbuster" settlements always drive FCA recoveries, the rest of this quarter's numbers give reason to question whether the down trends of FY2020 will persist. All other recoveries from this quarter combined amount to less than $209 million (less than the second settlement mentioned above), making this quarter the most lopsided in recent history. And the total number of recoveries this quarter—48—is the lowest since FY2018.

Among the remaining recoveries, many of the trends we have seen in recent years held constant. Healthcare-related cases made up the majority of recoveries, representing 66% of the amount recovered. Qui tam actions made up a small majority of the total number of settlements (26 of 46), but more than three-quarters of the total dollars recovered.

That being said, there were a handful of notable and sizable recoveries from outside the healthcare industry, with recoveries from government-service providers making up a significant chunk of the quarter's recoveries. For example, in an action out of the Southern District of California, the government recovered $24.9 million from a mortgage company that was alleged to have breached material program requirements when it originated and underwrote mortgages insured by the Department of Housing and Urban Development's (HUD) Federal Housing Administration (FHA). In the District of Columbia, nearly $19 million was recovered from a government contractor providing health care and IT services and solutions to federal agencies that allegedly overcharged for services performed and provided false information concerning commercial discounting practices during contract negotiations. And in an action out of the District of Vermont, the government recovered nearly $10 million from a contractor that allegedly provided inflated quotes for energy savings upgrades, such as solar panels, LED lighting and insulation, in federal buildings.

Only time will tell if any of these trends will persist this fiscal year, but we at Qui Notes will continue to monitor recoveries as they are announced. Stay tuned for updates.

© Arnold & Porter Kaye Scholer LLP 2021 All Rights Reserved. This blog post is intended to be a general summary of the law and does not constitute legal advice. You should consult with counsel to determine applicable legal requirements in a specific fact situation.