FCA Recoveries in First Half of FY24 Continue Trend Away From Early 2020s’ Lows

With the end of March signifying the halfway point in the federal government’s fiscal year, we thought it would be a good time to take a look at the Department of Justice’s (DOJ) midyear False Claims Act (FCA) recovery statistics. (We track these statistics based on public reporting, and you can view them in more detail on our Statistics page and in our Recoveries List.) In our post summarizing DOJ’s final statistics for fiscal year (FY) 2023, we noted that, though FCA recoveries remained below average compared to the 2010s, signs pointed to increases as covid-related litigation slowdowns fall further into the rearview mirror. Halfway into the 2024 fiscal year, it appears this is beginning to pan out.

Through the end of March 2024, DOJ’s reported FCA recoveries total US$1.52 billion, putting it on pace to break the US$3 billion mark, which it routinely eclipsed between FY10 and FY19 but has only hit once since FY20. Notably, the increase in the dollar value of recoveries has occurred despite a relatively small number of recoveries: 107 through six months, which puts DOJ on pace for 214, as compared to 273 recoveries in FY23 (excluding Paycheck Protection Plan (PPP) recoveries, which were numerous in FY23, but on average much smaller than non-PPP recoveries). That, in turn, reflects that DOJ’s average recoveries have increased to US$14 million from last year’s figure in the US$9 million range (again, excluding PPP recoveries).

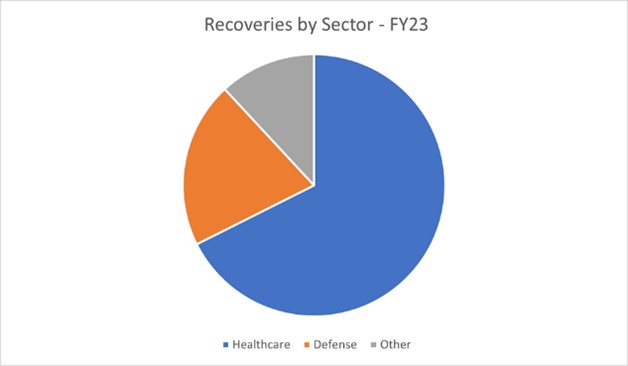

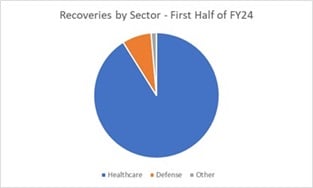

While the size of DOJ’s recoveries thus far in FY24 appears to be a continuation of last year’s trends, the breakdown of those recoveries by industry shows notable differences. In recent years, we’ve seen a steady increase in the proportion of non-health care recoveries within the total FCA mix. In the first half of FY24, by contrast, US$1.36 billion of DOJ’s recoveries have been health care-related, equating to about 90%. More than a third of the US$1.36 billion figure came from a global settlement with a large pharmaceutical company related to the manufacture and sale of opioids. The industry breakdown is more in line with what we had seen in prior years, until the share of health care recoveries declined to 80% in FY22 and to roughly 67% in FY23. Given DOJ’s focus on non-health care FCA enforcement via its Civil Cyber-Fraud Initiative and in other arenas, we wouldn’t be surprised if recoveries in other sectors pick up as the year goes on.

In short, this year’s statistics so far point to a return to many of the hallmarks of the 2010s: increasing recoveries, heavily concentrated in the health care sector. That said, these statistics are just a snapshot based on public reports and could well change once DOJ’s full-year statistics for FY24 come out. As we noted in our summary of DOJ’s FY23 statistics, another key metric — new FCA matters initiated — broke records last year. As those hundreds of cases continue to progress, we could see even more recoveries or changes in the breakdown across industries. To be sure, we may not see those effects this year; as Qui Notes readers will be well aware, FCA cases often take (significantly) more than a year to resolve — especially if there is to be a big-ticket recovery. We’ll continue to monitor and report back as this and other developments in the FCA landscape take shape over the remainder of this year.

© Arnold & Porter Kaye Scholer LLP 2024 All Rights Reserved. This blog post is intended to be a general summary of the law and does not constitute legal advice. You should consult with counsel to determine applicable legal requirements in a specific fact situation.