Latest Developments in EU Antitrust and ESG

Introduction

The last three years have seen a flurry of activity as competition regulators have set out to explain the framework for assessing sustainability agreements under the competition rules. For companies and their advisors, this has led to significant efforts to follow and make sense of what they can and cannot do, particularly because regulators have adopted greatly varying approaches.

Several guidance documents have been adopted by competition authorities in the EU, including the European Commission (EC) and national competition authorities. A few national regulators have also encouraged companies to seek informal guidance on concrete initiatives, and subsequently adopted decisions on such initiatives.

Our analysis provides a digest of this multitude of guidance and decisions. We provide an overview of the learnings regarding permitted and prohibited conduct and discuss the shortcomings of the current state of regulation.

New Guidance at the EU-level

The EC has adopted its long-awaited guidelines for the assessment of sustainability agreements (EU Sustainability Guidelines), i.e., agreements between competitors that pursue sustainability objectives.1 This is the first dedicated guidance on how those agreements will be assessed at the EU level, and is a major step forward in the EC’s efforts to clarify the interplay between ESG and competition law and policy. However, as the EC lacks sufficient concrete experience, the guidance remains rather general and somewhat cautious. This is bound to create a lot of uncertainty, as important questions are left open for businesses to interpret as they self-assess their sustainability initiatives. Sustainability collaboration often is with competing companies, and the enforcement seen to date has been aggressive and headline-grabbing — notably in the area of sustainability related cartels. As a result, there is a risk that the general and cautious guidance will have a deterrent effect on companies assessing compliance risks as they decide whether to engage in collaborative ESG projects, and how ambitious to make those projects.

Scope of the EU Sustainability Guidelines

The EU Sustainability Guidelines provide a framework to assess the compatibility with Article 101 TFEU of agreements between competitors that pursue sustainability objectives, irrespective of the form of cooperation or type of agreement.2 A relevant agreement could be reached in writing or orally, bilaterally or in the framework of a trade association or another forum of cooperation between businesses.3 The notion of “sustainability objectives” is interpreted broadly and is not limited to addressing climate change, but also includes respect for human rights, ensuring living income, animal welfare, resilient infrastructure and innovation, reducing food waste, and other objectives.

Explicitly Allowed Agreements

The EU Sustainability Guidelines explicitly state that sustainability agreements that do not affect the main parameters of competition — price, quantity, quality, choice, or innovation — fall outside of the scope of the prohibition in Article 101 TFEU.

.jpg?h=400&w=400&rev=6bdd71c8771840729705b54b2eb656b2&hash=8CAD4A1C95FA9AD10B3293ADCF7427A1)

The EC gives four examples of such agreements (although this list is not exhaustive):

- Agreements aimed solely to ensure compliance with requirements and prohibitions in legally binding international agreements which are not fully implemented or enforced by the Member State.4

- Agreements concerning the internal corporate conduct of companies to increase their ESG reputation, e.g., measures to not use single-use plastics in their own offices.

- Agreements setting up databases with general information on suppliers that follow sustainable/unsustainable practices if these do not prohibit or oblige parties to purchase products from such suppliers.

- Agreements to organize industry-wide awareness campaigns on environmental and other impact of consumption if they do not amount to joint advertising.

In addition, the EU Sustainability Guidelines create special rules for the assessment of sustainability standardization agreements (a so-called “soft safe harbor”). Competitors may wish to agree or commit to (or refrain from) certain practices by adopting and adhering to sustainability standards (including quality marks and labels). The EU Sustainability Guidelines start from the assumption that this type of agreement inherently involves competition risks, and therefore has set out six conditions that need to be met cumulatively for the agreement to escape scrutiny:

1. The procedure for developing the standard must be transparent and open to all that are willing to participate.

2. The sustainability standard must not prescribe direct or indirect obligations for companies that do not want to participate.

3. Participants must remain free to apply higher sustainability standards than those imposed by the agreed-upon standard.

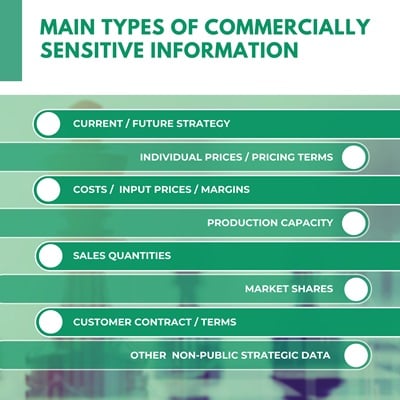

4. Participants must not exchange commercially sensitive information that is not objectively necessary and proportionate for the development, implementation, adoption, or modification of the standard.

5. Effective and non-discriminatory access to the conditions and requirements for using the agreed label, logo, or brand must be ensured, allowing companies to join at a later stage.

6. The sustainability standard must either (1) not lead to a significant increase in price or reduction of quality of the products or (2) the combined share of participating companies must not exceed 20% in the relevant market affected by the standard.

Restrictive Agreements

Sustainability agreements (including coordinated conduct) that restrict competition by object, e.g., because they are used to disguise price fixing, market sharing, or customer allocation, are prohibited.5 The agreements or conduct will be assessed as hard-core restrictions, such as cartels.

All other sustainability agreements (i.e., those that are neither explicitly allowed nor found to be restrictive by object) need to be assessed on their effects in order to determine how the EU antitrust rules apply. The assessment will depend on the nature of the agreement and the extent to which it affects the main parameters of competition and limits participating companies’ decision-making independence in this regard. It also focuses on the market power of the participating companies, the market coverage of the agreement, and whether it is likely to result in price increase or reduction of output, quality, variety, or loss of innovation — including loss of competition based on sustainability innovation.

Assessment Under Article 101(3) TFEU

Most sustainability agreements will lay in the “gray zone” between “byobject” restrictions and explicitly allowed initiatives. The assessment can be complex, and at the EU level, it falls on companies to undertake this assessment by relying on the EC’s guidance. And while the EC has opened the door for informal guidance to companies on novel questions that present a greater level of uncertainty,6 for the reasons explained further below, the effectiveness of this option remains questionable.

Sustainability agreements that can negatively affect competition are not necessarily prohibited. They can be excused under Article 101(3) TFEU on the condition that all four requirements for exemption are met.

Most controversial is the question of how to interpret the condition that a fair share of the benefits from the agreement be passed on to consumers. Traditionally, the relevant “consumers” for these purposes are the immediate users of the product or service covered by the agreement (individual use value benefit). The EC has shown openness to also consider broader benefits linked to consumers’ appreciation of the impact of their sustainable consumption on others (individual non-use value), e.g., broader environmental benefits. However, the EC requires robust evidence showing the actual preferences of consumers (as opposed to their stated preferences which may be overstated). These risks can be a significant obstacle for companies hoping to claim such benefits, as the cost, effort, and time required to gather the required evidence, and make sure it is reliable, may be too onerous.

The EC also discusses the possibility to recognize collective benefits, i.e., benefits that arise for the broader society irrespective of the individual appreciation of the consumers in the relevant market. Collective benefits are only considered if consumers in the relevant market substantially overlap with the beneficiaries or form part of them. That significantly limits the likelihood of the EC granting exemption for an agreement that aims to ensure living wages for workers in a sector in a region outside of the EU, if the consumers of the product in the EU do not (or only marginally) benefit from it.

| Type of Benefits | Can Outweigh Harm Caused by Agreement |

|

Individual use value benefits Consumer benefits from improved product quality or variety (e.g., better taste or healthier vegetables due to use of non-restricted fertilizers). |

Y |

|

Individual non-use value benefits Benefits resulting from consumers’ appreciation of the impact of their sustainable consumption on others (e.g., use of electric cars not because they drive better, but because they reduce pollution). |

Y, but difficulties to assess actual preferences versus stated preferences. Parties to agreements need to provide evidence for actual preference. |

|

Collective benefits Occur irrespective of the consumers’ individual appreciation of the product and accrue to wider society than just consumers for the product. |

Y, provided that the group of consumers that is affected by the restriction and that benefits from the efficiencies is substantially the same. |

Approach of NCAs

Several NCAs have taken a less cautious approach, encouraging collaboration and offering more concrete guidance around sustainability agreements; the approach implies an active use of competition law to promote efforts towards achieving ESG goals.

The Dutch authority (ACM) has been leading the way. It adopted its first draft guidelines on the assessment of sustainability agreements in 2020, subsequently amended in 2021. The Dutch approach is seen as more liberal than that set out in the EC’s guidelines. Following the publication of the EU Sustainability Guidelines, the Dutch ACM issued a new policy rule “ACM’s oversight of sustainability agreements” in which it confirmed that its approach is in line with the EU Sustainability Guidelines, but adding two important scenarios to the list of circumstances in which it will not take enforcement action: (1) where businesses agree to comply with a binding national or European sustainability rule that is not (or cannot be) fully implemented or enforced and (2) where businesses agree to efficiently achieve environmental goals, such as reduction of CO2 emissions, provided the consumer receives an appreciable and objective share of the benefits. The last requirement could potentially go as far as substantiating “collective benefits” regardless of whether the group of users of the products and the consumers benefiting substantially overlap.

Other “pro-active” authorities include the Austrian Federal Competition Authority (FCA) that published guidelines on sustainability cooperation agreements in September 2022; the German Bundeskartellamt, which instead of guidelines has assessed several specific cases and published its decisions, including where no concerns were found; and the Greek competition authority that has established a “regulatory sandbox” for sustainability initiatives — a space for companies to run their sustainability initiative by the regulator before implementing them to seek comfort that the initiative is compliant.7

In the UK, the Competition and Markets Authority recently published guidelines on the application of UK antitrust law to environmental sustainability agreements. The guidelines invite companies to submit their initiatives for informal guidance and promises in return for a “light touch review” with the possibility to suggest amendments and not impose fines if those are implemented.

What Is Allowed and What Is Not Allowed?

In addition to the specific exemptions discussed above, the growing body of decisional practice from authorities that have assessed specific cases over the last couple of years, provide useful insight on where to draw the boundaries of allowed conduct. We have summarized the key aspects in the table below.

| Type of Arrangement | Allowed/Not Allowed | Outcome8 |

|

Non-competition agreement preventing companies from advertising the individual environmental performance of their products.9 |

N | Prohibition decision — effect of the agreement was to eliminate “competitive marketing practices based on environmental characteristics” |

|

Coordination on:10

|

N | Prohibition decision with imposed record fine of €2.93 billion |

|

N | Prohibition decision with imposed fine of €875 million |

|

Agreement on common standards and strategic goals to ensure living wages on a voluntary basis, including joint introduction of responsible procurement practices and development of processes for monitoring transparent wages. |

Y | No restriction of competition was found because:

|

|

Agreement between agricultural, meat production, and food retail sectors to pay standard premium to livestock owners for improving the conditions of life of animals via participating slaughterhouses. |

Allowed for transitional period and replaced later by a non-binding recommendation to pay compensation for animal welfare costs instead of a standard premium.12 |

|

|

Agreement between milk producers to retroactively stabilize the contractually agreed raw milk price paid to farmers including a standard surcharge determined based on the cost of milk production. |

N — would have led to increase in milk prices. Surcharges would have been passed on along the supply chain down to the customer. | No processes regarding sustainable milk production were in place.14 |

|

Agreement between network operators to store CO2 on a large scale in a common storage place and jointly offer customers the first 20% of the storage capacity. |

Y |

|

|

Multi-year agreement between business users of energy and water to jointly purchase electricity from one wind farm. |

Y |

|

|

Agreement between soft drink suppliers to discontinue plastic handles on all soft drink and water multipacks. |

Y |

|

|

Agreement between garden centers not to supply plants from growers that use illegal pesticides and to exchange information on such growers. |

Y |

|

| Y15 |

|

|

| A joint initiative of representatives of public authorities, companies of the cocoa and chocolate industry, a major part of the grocery trade, and international non-governmental organizations that encourages members to voluntarily commit themselves to individualized minimum prices, quotas, and premium systems to achieve better farm gate prices for producers. | Y |

No restriction

|

|

Agreement between commercial waste collectors to offer contracts with at least two waste streams. |

Y |

|

|

An agreement between retailers to apply a joint fixed additional price on disposable cups and meal packaging for customers.

|

N — does not pursue sustainability goal | - |

|

Agreement between companies and trade associations not to disclose to consumers the presence of chemicals in food packaging.16

|

Ongoing | - |

|

Agreement between car manufacturers to limit payments to vehicle recycling companies.

|

Ongoing | - |

Shortcomings of the Regime

Overall, important steps have been made in the last three years in Europe in order to integrate sustainability considerations within regulators’ antitrust policy, and to use competition law as a tool to promote ESG (and incentivize the private sector to contribute to this cause). However, in our view, we still are far from where (most) regulators, businesses, and consumers want to be, and the current situation has its shortcomings that require addressing.

First, the EU Sustainability Guidelines remain too general and cautious, often leaving businesses to guess how a concrete initiative that does not meet one of the safe harbors will be assessed. While this concern is not unique to these guidelines, it is compounded by the apparent tension between the EC’s approach (and indeed that of other large jurisdictions around the globe) and the seemingly more permissive approach of some NCAs when determining which type of sustainability agreements they feel comfortable with, as well as the EC talking up cartel enforcement linked to ESG and sustainability. Combined, we worry that faced with this situation, many companies and trade associations will err on the side of caution and opt for the less ambitious route as they collaborate on ESG. As many ESG goals (and in particular those of a global nature, such as reduction of greenhouse gas emissions) cannot realistically be achieved by companies acting individually, the situation is unfortunate.

Second, the EC Sustainability Guidelines still seem to put a disproportionate emphasis on the benefits agreements should have for consumers of the products at stake compared to those for the environment and other ESG goals more broadly. This makes it more difficult and costly for companies to craft arrangements that will not get them into trouble with the regulator. It also significantly limits the potential to extract benefits from private cooperation; and it is noteworthy that so far, we mostly have seen examples of local cooperation, closer to the markets where final products are sold.

Third, some NCAs (the ACM, the Bundeskartellamt) have given timely (one to three months) and helpful guidance to companies and cleared several initiatives. The EC has recently updated its Informal Guidance Notice to loosen the criteria required for companies to seek such comfort from the EC. Companies are now entitled to get guidance letters if the agreement or initiative at stake raises “novel or unresolved questions” where there is “no sufficient clarity in the existing Union legal framework.” This updated tool has not been used to assess sustainability initiatives yet, and it remains to be seen how quick and open the EC will be to provide such guidance, including in a manner that is not all too cautious. Experience with comfort letters in other areas suggests that the EC may worry that any comfort it provides is too broad or may worry about being too permissive where comfort is provided without a full investigation. The result has tended to be letters which largely restate known views.

Fourth, one of the requirements to obtain clearance is to show that the benefits to consumers outweigh the restrictive effects of the agreements on competition. The EC Sustainability Guidelines not only have limited tolerance towards putting forward benefits to the society at large, but have set a high bar on the type and quality of the evidence that companies would need to present to get the regulator comfortable. At the same time, they have provided limited guidance on the appropriate method to quantify sustainability benefits. This raises the cost and efforts companies must invest to comply with the requirements.

Conclusion for Businesses

There is an abundance of proposed new or updated regulations that increase the requirements for companies desiring to run their business in a more sustainable way (including, the Corporate Sustainability Reporting Directive,17 the proposed Corporate Social Responsibility Due Diligence Directive,18 the proposed Directive on Packaging and Packaging Waste,19 the proposed Directive on green claims,20 etc.). This is a difficult place to be as businesses must balance compliance risk and raising their profile to investors, consumers, and stakeholders. The broader and more ambitious ESG collaborations, aiming to fix fundamental supply chain issues, will often involve negotiations with a broad range of interested parties (e.g., participants at different levels of the supply chains as well as governments in both low- and high-income countries) with varying interests and levels of awareness of the competition rules. The lack of an ambitious and coherent approach of competition regulators in the EU, and indeed worldwide, risks having a cooling effect on initiatives.

At the same time, for all their shortcomings, the multitude of initiatives by regulators across the EU do clearly signal wider support for sustainability agreements. While assessments may be complex once companies venture beyond local or lighter touch cooperation, we begin to understand how regulators are likely to think about the competition issues that may come up. It now is up to companies to take up the challenge and invest in competition law assessments early on so compliance does not become the reason that ambitious collaboration efforts do not see the light of day.

Finally, businesses that operate globally will need to consider global regulatory risk and recognize that the legality of ESG efforts will be determined by the most aggressive competition law regimes. This is a particular consideration for companies that operate or sell in the United States, given the investigations of ESG agreements by state attorneys general and the cautious statements of federal antitrust enforcers.21

© Arnold & Porter Kaye Scholer LLP 2023 All Rights Reserved. This Advisory is intended to be a general summary of the law and does not constitute legal advice. You should consult with counsel to determine applicable legal requirements in a specific fact situation.

-

The EU Sustainability Guidelines are incorporated as a chapter in the final guidelines on the applicability of Article 101 of the Treaty on the Functioning of the European Union to horizontal co-operation agreements (EU Horizontal Guidelines) adopted in June 2023.

-

Article 101 TFEU does not apply directly to producers of agricultural products, but the TFEU provisions on the Common Commercial Policy refer to it. The area is subject to implementing regulations such as Regulation (EU) No 1308/2013 on establishing a common organization of the markets in agricultural products (CMO Regulation). Article 210a of the CMO Regulation creates an exemption for agreements of producers of agricultural products that pursues a sustainability goal higher than one prescribed by the EU or national law from the Article 101 TFEU prohibition, subject to certain conditions.

-

Since sustainability agreements are not a distinct category of horizontal cooperation agreement, where a horizontal cooperation agreement corresponds to one of the types of horizontal agreements covered by other parts of the EU Horizontal Guidelines and also pursues a sustainability objective, it should be assessed on the basis of the guidance contained in the relevant other chapter(s), together with the guidance provided in the chapter on sustainability agreements.

-

This category is new compared to the draft EU Sustainability Guidelines published in 2022.

-

For example, Case AT.39824 — Trucks included allegations of collusion over timing for the introduction of emission technologies for trucks to comply with emissions standards and the passing on to customers the costs to meet those rules. In Case AT.40178 — Car Emissions (the Car emissions cartel), several car manufacturers were found to have colluded on technical standards in relation to the cleaning of car exhaust. This year, the EC, together with the UK Competition and Markets Authority (CMA), conducted surprise inspections at premises of trade associations and member companies involved in recycling end-of-life vehicles on concerns they may have colluded in relation to the collection, treatment, and recovery of end-of-life cars and vans that are considered waste.

-

Commission Notice on Informal Guidance Relating to Novel Questions Concerning Articles 101 and 102 of the Treaty on the Functioning of the European Union that Arise in Individual Cases, 2022 OJ (C 381/07) 9.

-

See Sustainability Sandbox, Hellenic Competition Comm’n. Based on publicly available information, this option has not been used by companies yet.

-

Includes indication on whether the authority issued a prohibition decision, found that there was no restriction of competition (including the criteria it used to conclude that), or whether an exemption was granted.

-

Autorité de la Concurrence, available here.

-

-

Case AT.40178 — Car Emissions.

-

Bundeskartellamt Press Release, “More competition elements to be included in animal welfare initiative “Initiative Tierwohl” — Bundeskartellamt achieves abolishment of compulsory premium,” May 23, 2023.

-

Initiative was assessed under Article 210a of the Common Market Organization.

-

Initiative was assessed under Article 210a of the Common Market Organization.

-

Belgian competition authority took into account transparency for the participants in the standard selection process, voluntary participation, freedom of participants to set stricter standards, no (possibility of) exchange of commercially sensitive information, effective and non-discriminatory access to the requirements and conditions of the standard, no significant price increase or choice reduction, and continuous monitoring of the implementation of the sustainability standard.

-

Competition Policy International, “French Watchdog Says Companies Colluded to Not Disclose Chemicals Packaging,” October 13, 2021.

-

Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC, and Directive 2013/34/EU, regarding corporate sustainability reporting, OJ L 322, 16.12.2022, pp. 15-80.

-

Proposal for a Directive of the European Parliament and of the Council on Corporate Sustainability Due Diligence and amending Directive (EU) 2019/1937.

-

Proposal for a Regulation of the European Parliament and of the Council on packaging and packaging waste, amending Regulation (EU) 2019/1020 and Directive (EU) 2019/904, and repealing Directive 94/62/EC, COM/2022/677 final.

-

Proposal for a Directive of the European Parliament and of the Council on substantiation and communication of explicit environmental claims, COM/2023/166 final.

-

For further information see our Advisory from August 18, 2022, “Questioning ESG Commitments, State AGs Raise Antitrust Concerns,” and our online webinar hosted on August 19, 2022, “ESG Investigations Series: Navigating the Minefield of State AG, DOJ, and FTC Enforcement Risk.”