OECD Phase 4 Report Praises US Anti-Bribery Enforcement But Recommends Areas for Improvement

On November 17, 2020, the 44-country Organisation for Economic Co-operation and Development (OECD) Working Group on Bribery adopted the Phase 4 Report on the United States (Report), lauding the country's anti-bribery regime under the Foreign Corrupt Practices Act (FCPA) and its commitment to the Convention on Combating Bribery of Foreign Officials in International Business Transactions (OECD Convention). The evaluation, led by OECD-designated expert examiners, noted the country's significant upward trend in enforcement and the leadership role it continues to play advancing anti-corruption norms globally.

Robust Enforcement Over the Past Decade

According to the Report, between September 2010 and July 2019, the US brought 156 cases under the FCPA or related laws, resulting in 394 separate foreign bribery and related enforcement actions against 163 individuals and 175 corporations. On average, the Department of Justice (DOJ) reported 250 open investigations per year, while the US Securities & Exchange Commission (SEC) reported around 140 open investigations. This data demonstrates a substantial increase in enforcement activity since the OECD's Phase 3 Report from October 2010 and reaffirms the US's role as a global leader in the fight against transnational corruption.

The Report credited a number of factors for contributing to the high level of sustained enforcement activity against foreign bribery over the last decade.

First, the Report commended the US's "whole government" approach, in which multiple federal agencies are involved in FCPA investigations, including not only the SEC and DOJ, but also the Commodity Futures Trading Commission (CFTC), the Internal Revenue Service (IRS), US Immigration and Customs Enforcement (ICE), and the US Postal Inspection Service (USPIS). According to the Report, the agencies' enhancements in in-house expertise, interagency coordination, and increased resourcing have been major drivers of the increase in foreign bribery enforcement cases.

For example, the number of attorneys in the DOJ's Fraud Section's FCPA Unit has increased from the equivalent of 12 to 16 full-time attorneys in Phase 3 to approximately 30 attorneys. In addition to the increased staffing levels, staff continuity in the FCPA Unit has allowed for improved working relationships with foreign enforcement agencies, which the DOJ has noted is a key factor to the success of future FCPA enforcement actions.

In addition, and in coordination with lead DOJ and SEC prosecuting authorities, the CFTC, IRS, ICE, and USPIS have served as investigating agencies contributing their areas of expertise to ongoing FCPA investigations. Interagency sharing of digital resources and access to relevant agency intelligence has helped enhance the "whole government" approach to the fight against foreign bribery.

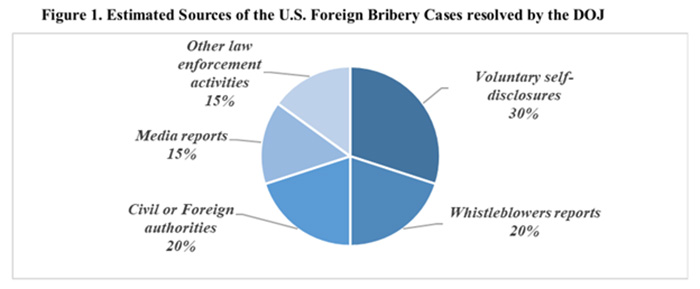

Second, the examiners praised US efforts to encourage companies to self-report foreign bribery offenses. In fact, according to data provided by US authorities, voluntary self-disclosures constitute the largest source of concluded DOJ FCPA enforcement actions:

Source: US Phase 4 Report, p. 13.

The Report specifically lauded DOJ's FCPA Corporate Enforcement Policy (CEP), piloted in 2016 and formally adopted in November 2017, for incentivizing corporate self-reporting. Under the CEP, companies that voluntarily self-disclose, fully cooperate with authorities, and timely and fully remediate offenses may receive significant reductions in penalties and may even avoid criminal prosecution.

Third, the examiners acknowledged that US authorities' frequent use of non-trial resolutions in FCPA matters—including declinations, non-prosecution agreements (NPAs), and deferred prosecution agreements (DPAs)—as "an important contributory factor to the U.S. high volume of concluded cases," especially in complex investigations and cases raising statute-of-limitations issues. As discussed below, while the Report raised certain concerns about the level of oversight and transparency of non-trial resolutions, it also commended such resolutions as "instrumental in the resolution of prominent multi-jurisdictional cases in which the United States ha[s] played a leading role."

Fourth, the Report praised the efforts of US authorities, especially the DOJ, to enhance transparency and clarity around FCPA enforcement through the publication of enforcement policies, guidance documents, and other resources, as well as detailed information about non-trial resolutions, such as NPAs and DPAs, on the DOJ website.

Recommendations to Enhance Foreign Bribery Enforcement

Beyond the generally positive review of US anti-bribery enforcement efforts, the Report also recommended areas for improvement.

Enhanced whistleblower protections

While noting that existing federal laws, including the Sarbanes-Oxley Act of 2002 (18 USC. § 154A) and Dodd-Frank Wall Street Reform and Consumer Protection Act (15 USC. § 78u-6), provide protections for certain categories of whistleblowers who report potential violations of US securities law (including the FCPA as it applies to issuers), the Report highlighted the existing protection gap for whistleblowers who report FCPA allegations about non-issuers or who report only to the DOJ rather than to the SEC. Accordingly, the Report recommended that the US further enhance the protection of whistleblowers who report potential FCPA violations about non-issuers and provide additional guidance on the protections available to different types of whistleblowers.

Increased transparency of NPAs and DPAs

While the examiners generally approved of the high level of transparency concerning NPAs and DPAs, they noted that US authorities could make publicly available information about decisions to extend companies' terms of resolution under NPAs or DPAs to provide additional time to comply fully with the agreement's terms, such as in connection with monitorship obligations. Similarly, the Report recommended publicizing when a company has successfully completed its obligations under an NPA or DPA. Although some of this information is filed with the relevant courts and therefore technically in the public domain, the Report suggests that more could be done for improved public access, such as posting the information on the DOJ website.

Continued evaluation of the Corporate Enforcement Policy

Given the relatively new implementation of the CEP, the examiners were not able to measure the impact of the program on enforcement. The Report therefore recommended that the US continue to evaluate the effectiveness of the CEP, in particular regarding its encouragement of self-disclosure and its deterrent effect on foreign bribery.

Continued focus on recidivism through sanctions

Noting concerns raised by civil society groups that the repeated use of settlements for companies with a history of enforcement actions only encourages recidivism and weakens the deterrent power of those very settlement resolutions, the Report encouraged US authorities to continue to address recidivism through appropriate sanctions and to raise awareness of its impact on the resolution of FCPA matters.

Continued refinement of policies and guidance

The Report also encouraged the SEC to consider consolidating and publicizing guidance on its FCPA enforcement policies, in line with DOJ's guidance documents and policies.

Conclusion

While other countries have stepped up their efforts to combat transnational corruption in recent years, the US continues to be the leading enforcer of laws against foreign bribery. Accordingly, US enforcement remains a model for other countries as they develop or strengthen their own anti-bribery regimes. The OECD's Phase 4 Report encouraged the US to continue to improve its own enforcement practices as the global leader in the fight against corruption in international business practices.

© Arnold & Porter Kaye Scholer LLP 2020 All Rights Reserved. This Advisory is intended to be a general summary of the law and does not constitute legal advice. You should consult with counsel to determine applicable legal requirements in a specific fact situation.